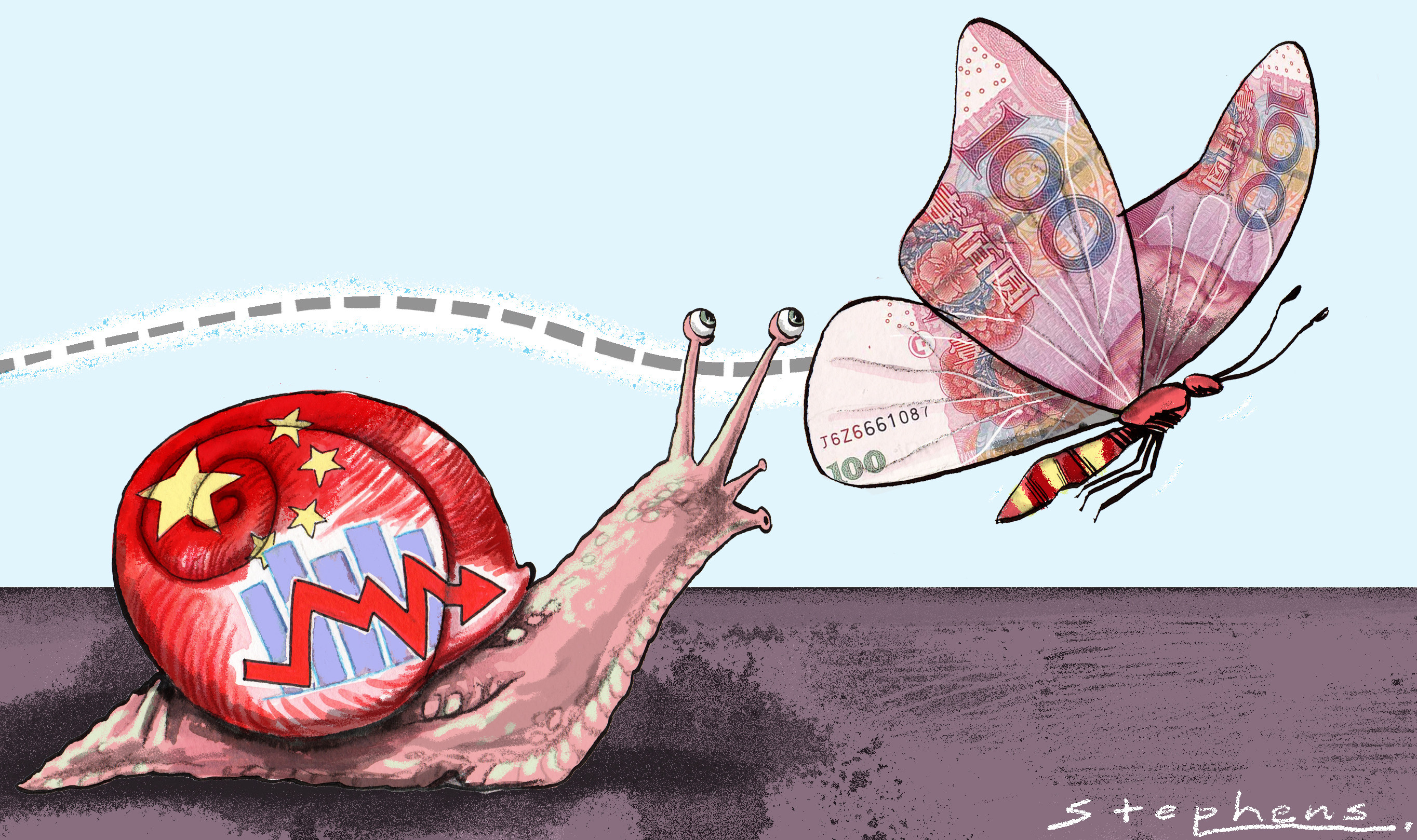

Beijing must let unsalvageable developers fail and, crucially, avoid saddling banks with bad loans. Short-term pain is preferable to infecting finance and creating a deeper, longer economic downturn.

Frankness about the nature of the difficulties an economy faces is a virtue, and it can benefit everyone from policymakers to employers and jobseekers. It is better to be transparent with the data as not doing so could make economic recovery harder than it otherwise might have been.

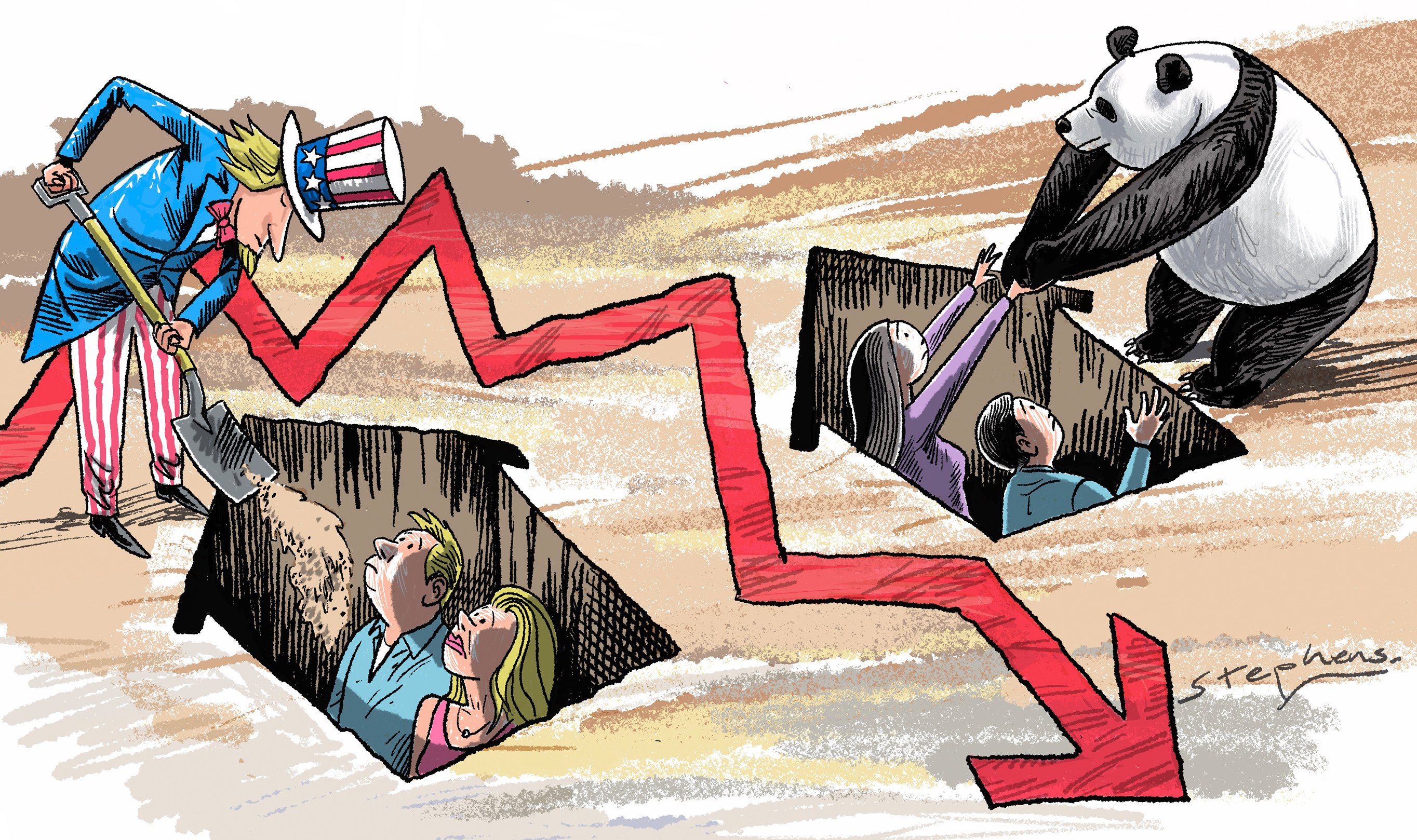

Any rescue plan for a crashing property sector should support prudent homeowners but penalise errant banks and companies. Bailing out the big banks while leaving ordinary citizens to suffer the pain of foreclosure, as the US did, will only fuel populist anger.

Politically and economically, China is superior to Russia in an unequal alliance that has seen growing Russian dependence. If Xi can craft an exit from war in Europe, China’s geopolitical stock will rise further.

As China looks to reform its banking regulations, it can avoid US pitfalls, such as letting regional banks lend excessively to one sector or allowing skewed boards. Importantly, the siren call of lobbying for looser banking rules and regulations must be ignored.

If China chooses to double down on an uncritical alliance with Russia, and supply it with military material, it risks US and EU sanctions. The better option would be for China to use its leverage and closeness with Russia to broker an end to the war.

China’s economy is entering a new phase of slower growth and policymakers need to respond. They must reaffirm their support for private enterprise, while doubling down on green investments to encourage sustainable and high-quality growth.

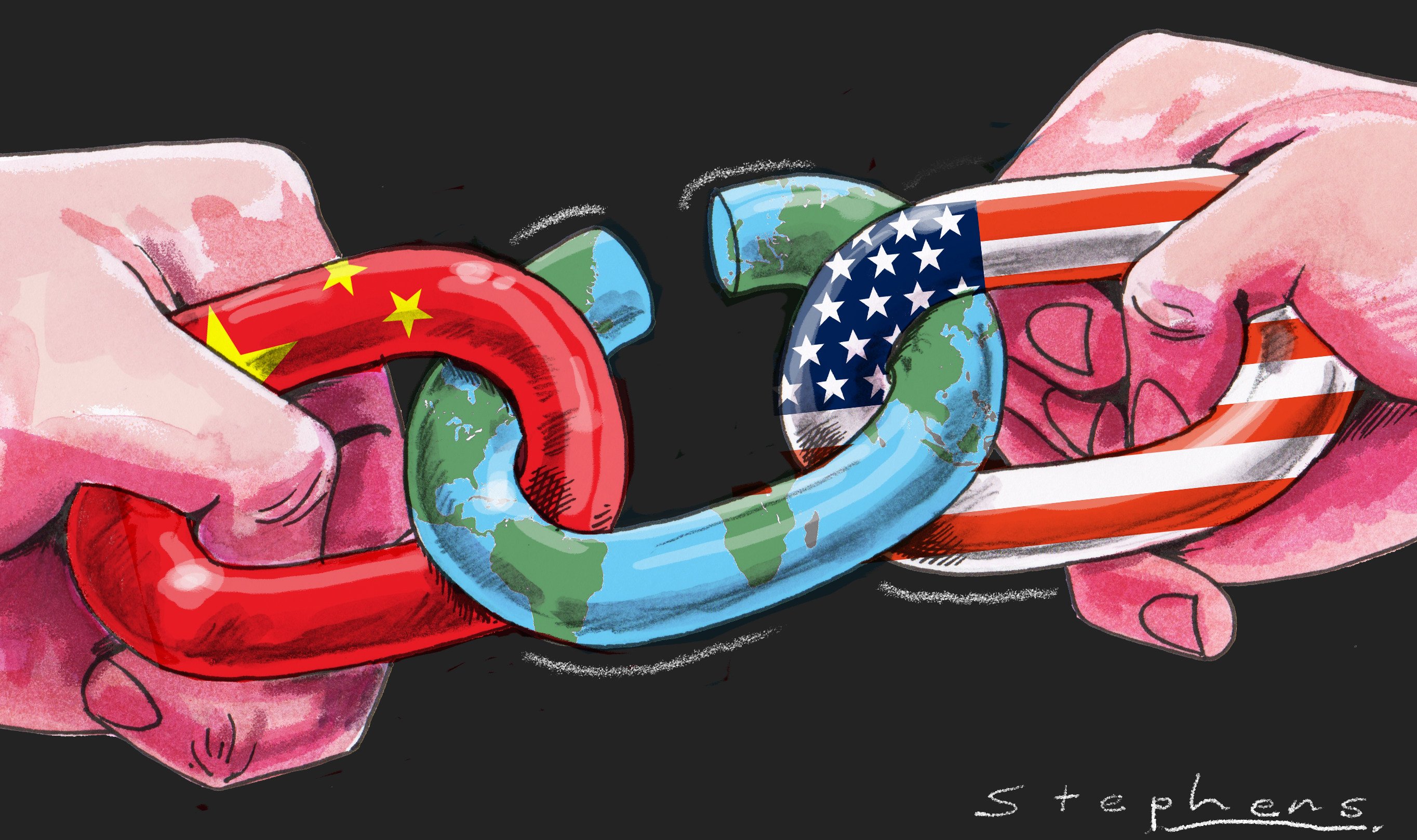

The unfolding trade, tech and cold wars between the US, China and their allies risk eroding the international rules-based architecture. Without a system for connection and exchange, economies will shrink, cooperation will wither and global crises will mount.

The growing housing crisis in China threatens to spread like previous financial contagions and damage economies across the globe. Avoiding crisis requires policymakers to let poor performers suffer the consequences of bad bets while looking after solvent banks and enacting reforms.

In its early years, the G20 oversaw cooperation on issues ranging from financial stability to inclusive growth. Today, major players are blocking it from operating effectively. Geopolitical tensions, war and new national security concerns mean the multilateral coordination of globalisation is now on life support.

Advanced economies must at some point begin to wind down their massive monetary and fiscal policy support to sustain recovery. Yet market corrections, business failures and economic contagion arising from a shadow banking or debt crisis could all torpedo the fragile recovery.