Given high borrowing costs, cooling measures and a surge in private home completions, it would be astonishing if Singapore did not see a slowdown. While the property sector is losing momentum, it is the kind of slowdown landlords and investors in most other markets would envy.

Concerns about the reliability and quality of economic figures in China are well known, but unease exists beyond Beijing. In the US, partisanship is skewing the data, so much so that it is shaping the economic narrative and exerting an influence on politics and policy.

India’s growing middle class, the right government support and a favourable external environment have given the property sector wings to escape the headwinds buffeting markets elsewhere.

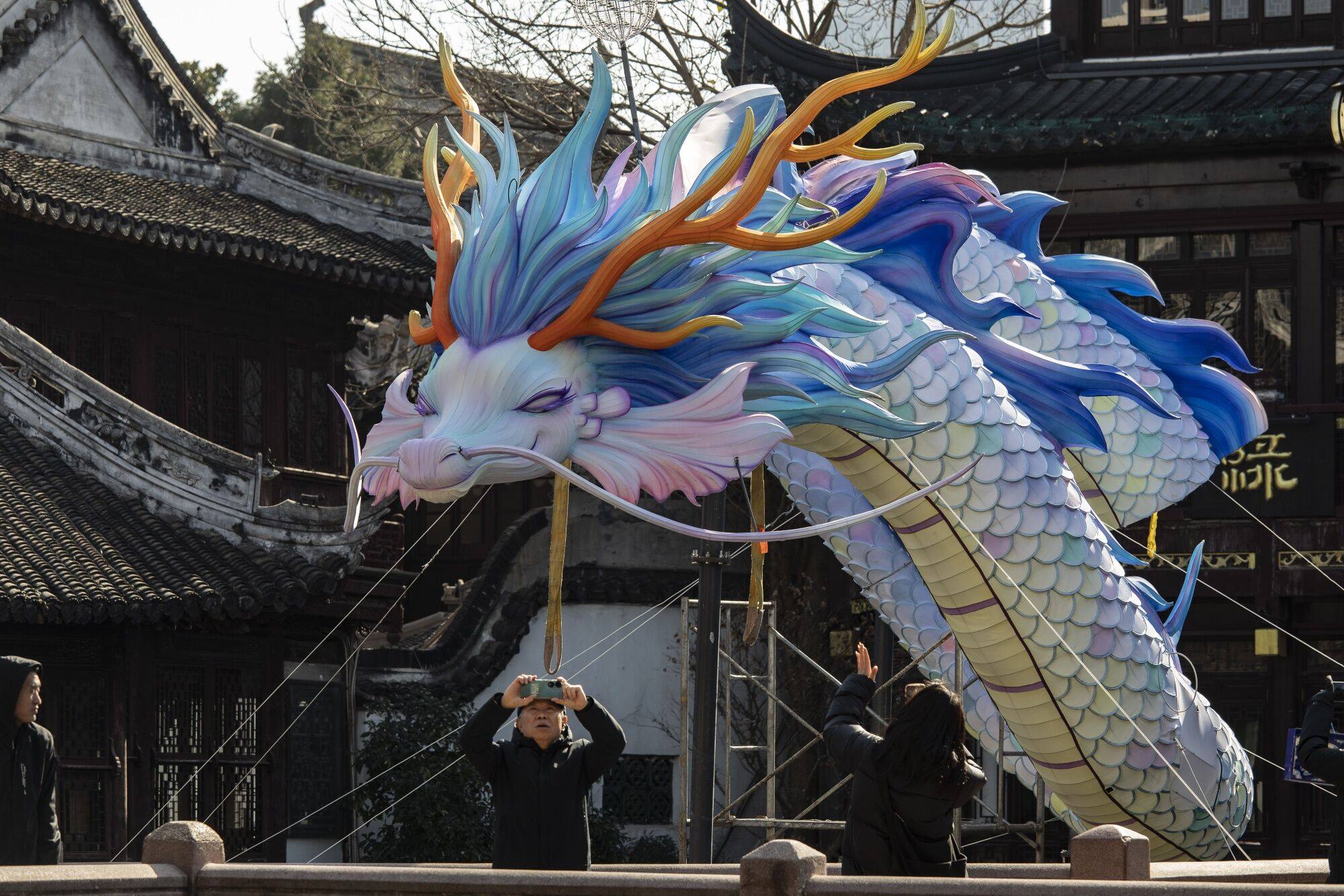

Tokyo has overtaken Shanghai to become Asia’s largest stock exchange, driven by investors keen to get exposure to the region while mitigating risks in China. However, China is an important source of revenue for Japanese firms in crucial industries, which would be hard hit by a deeper downturn in the world’s second-largest economy.

The emerging sector of multifamily properties is offering many untapped opportunities – especially in China, where catalysts for the institutionalisation of its rental housing market have coalesced in recent years.

The Fed must make the tough call on when to ease rates. Amid heightened risks of a major policy blunder, the impact of its decision on Asia – where the case for a looser policy is stronger – cannot be ignored.

The earthquake and plane collision earlier this month are unlikely to deter travellers as Japan continues to welcome record levels of tourists. The tourism rebound has aided the investment appeal of Japanese hotels, but so have loose monetary policy and a large domestic tourism market.

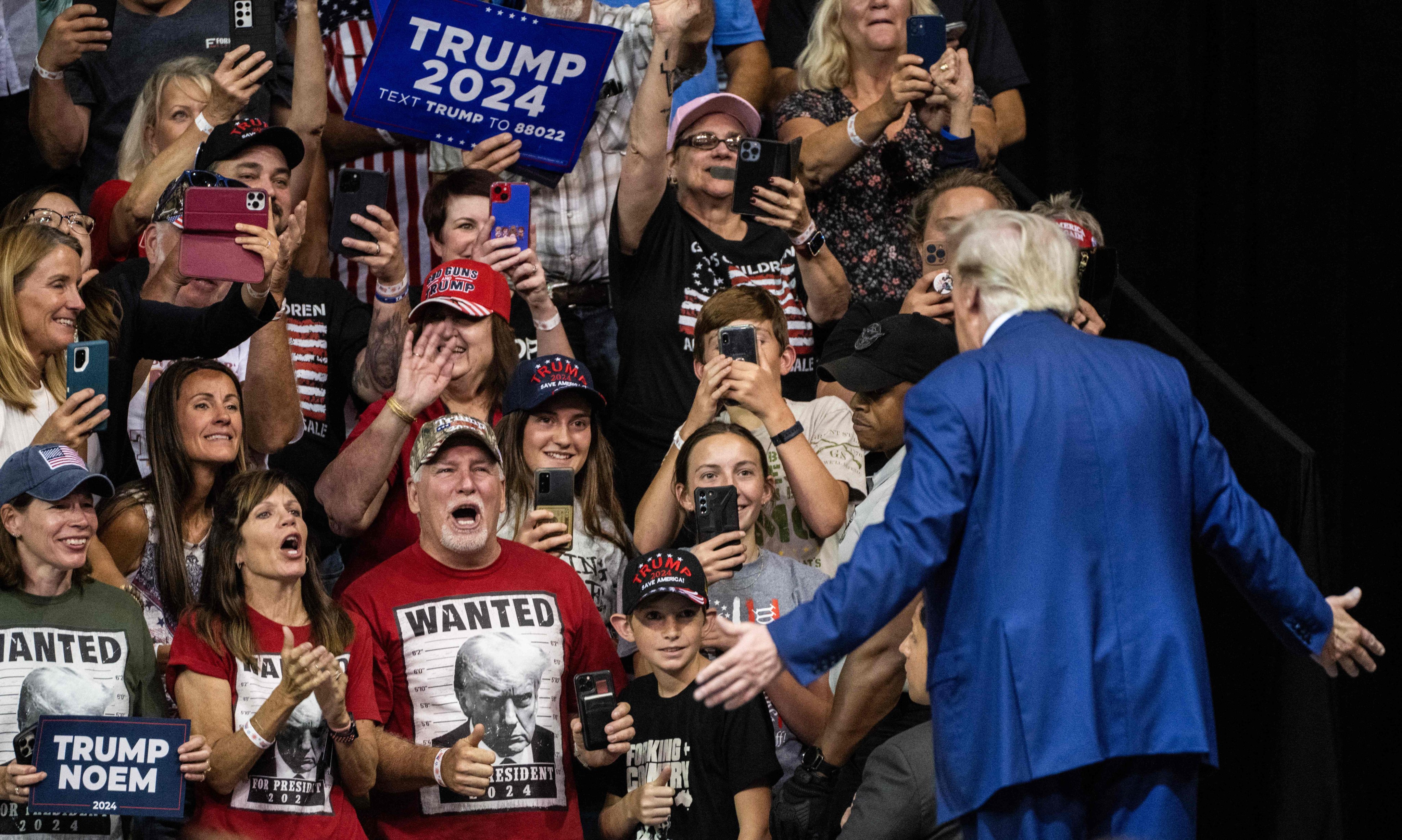

The 2024 electoral calendar is jam-packed as more than 4 billion people around the world will go to the polls, but one election has world-changing potential. The return of Donald Trump to the White House would be a gift to US adversaries while eviscerating its security commitments and crippling climate change efforts.

The big worries in Asian real estate from 2023 will persist this year, but sources of resilience and strength will also endure. Trends meriting close attention include Australia’s housing market, Chinese property beyond housing, an Indian real estate boom and retail property strength.

A growing number of investors in developing economies are carving China out of their portfolios, but they are merely trading one set of risks for another. Fund managers cannot ignore the influence China has over emerging markets, especially in Asia, and alternatives are not as cheap as they used to be.

The prospect of positive spillovers from mainland China’s economy stabilising and the US Federal Reserve’s dovish turn could mean a brighter 2024 for Hong Kong.

There is reason for optimism after the Federal Reserve’s surprise interest rate decision, but there are also still plenty of reasons for caution. The fact that markets are expecting the smoothest of touchdowns for the US economy next year should be ringing alarm bells.

Despite concerns about China’s economy and markets, some prominent strategists and fund managers are optimistic about the prospects for Chinese stocks. There is a sense that the economy has stabilised amid the property sector’s struggles, Chinese shares are affordable and parts of the market have proven resilient.

It is no exaggeration to say that the fate of the global economy, sentiment in financial markets, the future of liberal democracy and the scope for further geopolitical tensions and shocks will be almost entirely determined by events in the US next year.

China’s property crisis is just one of many signs that Asia’s housing sector troubles are far from over. Japan could be in for a shock if a shift from years of ultra-loose monetary policy pushes up lending rates, hitting home loans hard.

The main issue concerning investors is whether central banks are done raising interest rates and, if so, how large any cuts that happen will be. The spotlight shifting from China could offer policymakers more breathing room to act but also risks lulling investors into a false sense of security.

Persistently high rents, rising levels of outbound travel and an inability to respond to changing consumer tastes are holding back Hong Kong’s retailers. The city’s retail industry must be revitalised and better tap into Hong Kong’s unique strengths to make any recovery meaningful and durable.

Much like those who expected a roaring economic recovery in China this year, bears forecasting doom and gloom risk making a costly mistake. Stronger-than-expected data increases the scope for a meaningful rally, and investors would do well to show some humility in their predictions.

Expectations that leading Western central banks will cut interest rates next year have reached fever pitch, but these hopes are likely to be in vain. Investors banking on rate cuts must keep an eye on core inflation, central banks choosing pauses versus cuts and further shocks to the global economy.

Singapore’s housing market was bound to slow significantly after undergoing a boom in recent years, but there is no indication a steep decline is on the way. Moreover, the government has the policy tools needed to avert a sustained drop in prices

News around the US economy has been positive of late, but two alarming trends could undermine the improvement and scare off investors. If they gain momentum, the debate over whether the US will have a soft or hard landing will give way to deeper worries about its economy and democracy.

Asian buyers have spotted opportunities to acquire London assets at a critical moment – the price correction is entering its final stage and competition from other buyers will intensify when central banks start to loosen policy.

As China’s prospects darken, a bullish narrative is growing that India could become the biggest contributor to global growth. But this might be wishful thinking, given that while India has a large and youthful population, its labour force participation rate is worryingly low.

Australia’s housing market epitomises the themes that have characterised property markets globally: resilience, stress and affordability. Rising house prices and rents are driving inflation and contributing to tighter financial conditions, which then exacerbates affordability issues.

Investor sentiment around China’s prospects has remained sour despite a significant increase in the pace and scope of policy support for the economy. This discrepancy suggests China’s problems are too complex and multifaceted for global investors to grasp.

Hong Kong’s real estate market has endured five years of steady upheaval and shocks, with domestic and global factors adding to the strain. Even so, the outlook is not all doom and gloom as risks to financial stability are manageable and the downturn has inspired much-needed reforms.

Sell-offs are happening in markets around Asia despite key economic indicators improving, with core inflation in particular moderating. The overriding factor is a divergence in global monetary policies, with the rapid rise in US Treasury yields sucking capital out of emerging markets.

Despite encouraging third-quarter data, it is preposterous to expect any kind of meaningful recovery when the property sector is crumbling. The economy will continue bumping along the floor until new growth drivers offset the drag from the downturn in property and related industries.

Right now, Japan ticks many of the boxes that matter to fund managers thanks to its geopolitical appeal and outlier status on monetary policy. It is by no means immune to the turmoil in the global economy, especially if China’s economy continues to struggle and the US slips into recession.

it has become clear investors are out of their depth when it comes to gauging non-economic threats, particularly geopolitical risk. Analytical humility is more important than ever for those trying to make sense of the world.