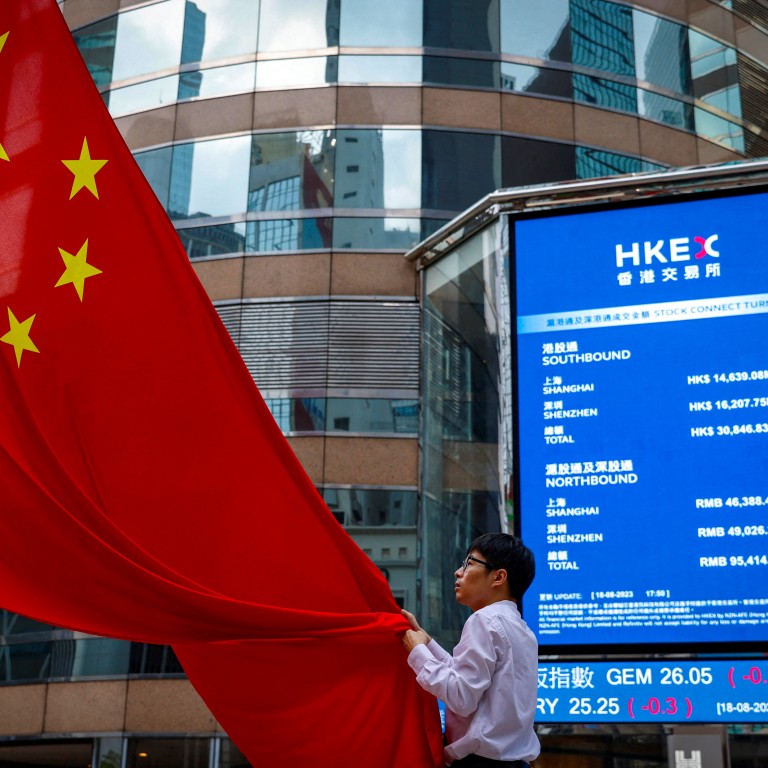

Hong Kong stock rally fizzles before Alibaba report as traders look to earnings, buy-backs, state support to lift sentiment

- Hang Seng Index retreats after rising to highest since January 11; markets look to Alibaba’s earnings to add to other recent bullish report cards

- State fund support may not sustain mini-rally as drivers of negative sentiment are not being addressed, says Brock Silvers at Kaiyuan Capital

The Hang Seng Index was little changed at 16,124.92 at the local noon trading break, after surging as much as 1.7 per cent to the highest level since January 11. The Tech Index gained 2.2 per cent, while the Shanghai Composite Index added 0.9 per cent.

Alibaba Group dropped 1.4 per cent to HK$74.95, overturning an earlier 1.4 per cent gain on expectations quarterly income from the operator of Taobao e-commerce platform on Wednesday will exceed forecasts. WuXi Biologics jumped 7.3 per cent to HK$19.48, while its affiliate WuXi AppTec gained 6.7 per cent HK$52.30 as they hastened repurchases after recent sell-offs.

Elsewhere, Sunny Optical gained 4.5 per cent to HK$50.65, and EV maker BYD climbed 2.4 per cent to HK$185.20.

Net income for Alibaba Group, the owner of this newspaper, probably rose 20 per cent from the previous three-month period to almost 48 billion yuan (US$6.7 billion) in the quarter to December 31, according to analysts tracked by Bloomberg. Other earnings on Tuesday from fast-food chain operator Yum China and chip maker SMIC smashed consensus forecasts, according to Bloomberg data.

Corporate actions are keeping the market upbeat in a week when China’s state-run funds and market regulator have intervened to arrest a slump in confidence. Stocks listed in Shanghai, Shenzhen and Hong Kong have lost more than US$5 trillion since 2021 as China’s post-Covid economic recovery ran out of gas.

This week’s almost 4 per cent turnaround in the Hang Seng Index followed bets among traders on China’s state-run funds to put a floor on the three-year slump, and amid speculation the losses have prodded the country’s top leader and regulators to reassess their responses.

Hong Kong stock market in for a topsy-turvy ride in Year of the Dragon: CLSA

Still, such tactics may exacerbate market concerns, said Brock Silvers, managing director at Kaiyuan Capital in Hong Kong. The current mini-rally on hopes for an artificially high floor for equities may eventually be seen as a propitious exit window, he cautioned.

“Authorities are clearly distressed by the market’s ongoing slide, but market interventions are unlikely to provide long-term relief,” he added. “Neither restrictions on short selling and derivatives, nor the deployment of the ‘national team’, will do anything to change the underlying drivers of negative sentiment.”

Chinese hotpot restaurant chain Haidilao rallied 1.1 per cent to HK$13.30 on optimism the weeklong Lunar New Year will boost revenue, riding on Yum China’s 14 per cent surge to HK$331.60.

Financial markets in mainland China will shut for the Lunar New Year from February 9 to 16. In Hong Kong, trading will be shortened to half a day on February 9 and close for the festival on February 12 and 13.

One stock made its debut on Wednesday. Chengdu Sino-Microelectronics Tech, a maker of integrated circuits, jumped 33 per cent to 20.86 yuan in Shanghai.

Other major Asian markets were mixed. Japan’s Nikkei 225 slipped 0.2 per cent, while South Korea’s Kospi rose 1.7 per cent and Australia’s S&P/ASX 200 added 0.7 per cent.