Topic

Latest news and analysis about the Hong Kong stock market, including market movements, policies, stock sales, and related exchange filings.

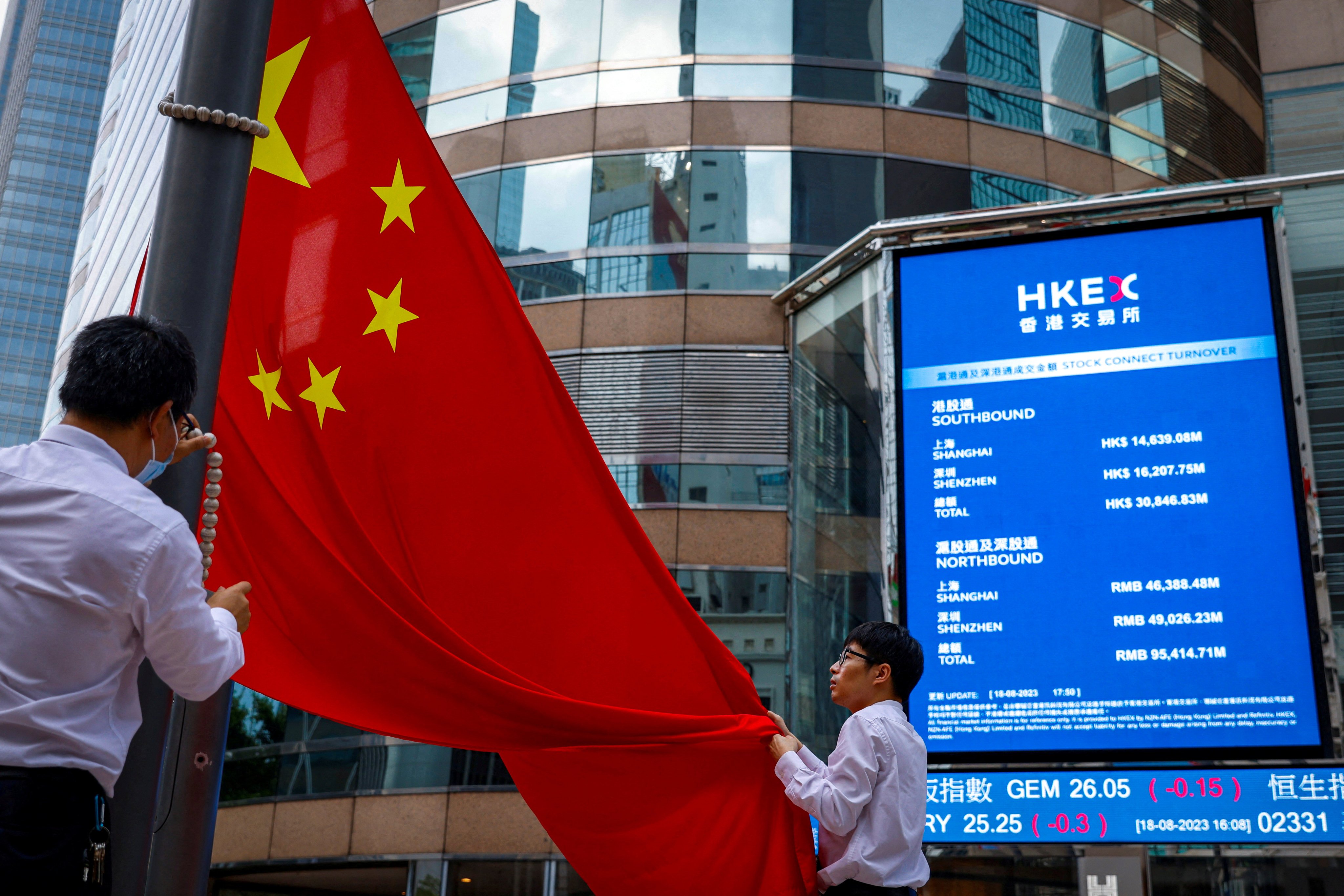

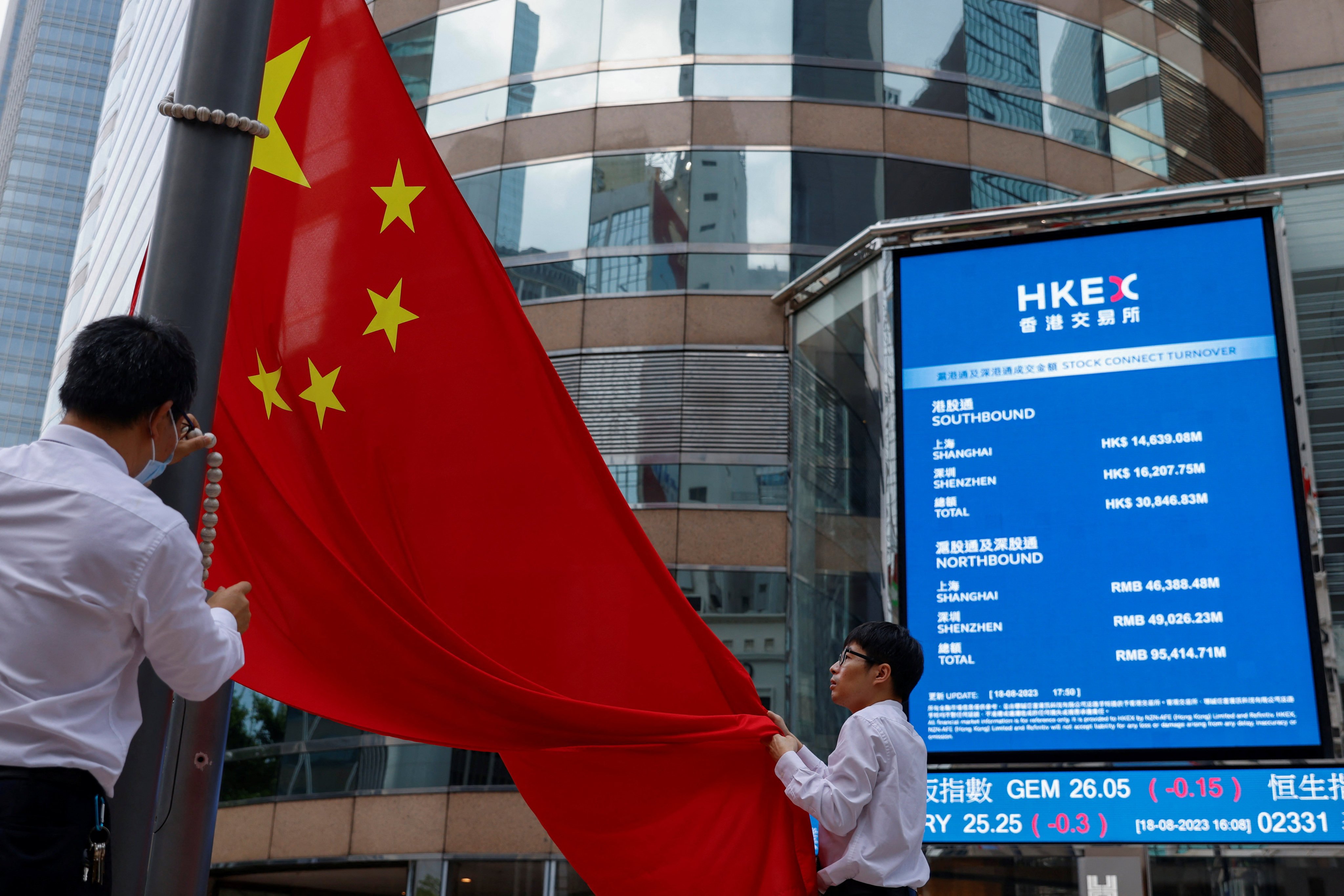

The chronic decline of stock prices in Hong Kong is a worrying trend, lending support to a narrative that the city’s financial prowess is in ‘ruins’, requiring concrete measures from Beijing to shore up confidence.

Hong Kong’s financial system is robust, but prudence is called for as even steady interest rates are likely to remain high for a while next year.

The new link between the exchanges in London and Shenzhen is also a boost for Hong Kong, as it will complement city’s role as one of the world’s most important financial hubs.

The unexplained vanishing of Bao could undo efforts by Beijing to win back the trust of investors since the end of its rigid zero-Covid policies.

- Hang Seng Index retreats after rising to highest since January 11; markets look to Alibaba’s earnings to add to other recent bullish report cards

- State fund support may not sustain mini-rally as drivers of negative sentiment are not being addressed, says Brock Silvers at Kaiyuan Capital

‘People are interested in India for several reasons, one is simply it’s not China,’ says Vikas Pershad, a money manager at M&G Investments in Singapore. ‘There’s a genuine long-term growth story here.’

A bull market is vital for China’s slowing economy because stock valuation has slumped to about 54 per cent of national output, from a record 79 per cent in 2021.

Hong Kong stocks jumped by the most since July while onshore equities logged a historic gain. Market regulator in Beijing pledged fresh measures to stop the rot, and the sovereign wealth fund made its market intervention public.

Hong Kong stocks fell on Monday, after the CSRC’s pledge to rein in wild fluctuations in the stock market did not include details as to how it will revive investor confidence. US Presidential hopeful Donald Trump’s threat that he may levy further tariffs on Chinese goods added to the gloom.

Chinese restaurant chain operators are grossly underpriced in the stock market, and they are set to expand their dominance as consumption rebounds, analysts say.

Readers discuss how the country can win over people, what normal looks like in Hong Kong, and Article 23 legislation.

Stocks declined, capping another week of losses, after WuXi Biologics suffered another major plunge. Market surrendered an earlier rally fuelled by favourable Beijing policy and robust EV deliveries in January.

Hong Kong’s stock market could see a roller-coaster ride full of turbulence and drama as a ‘groggy dragon stumbles out of its cave’, according to CLSA’s tongue-in-cheek predictions.

Stocks recovered from a 9.2 per cent sell-off in January as traders raised bets for a US rate cut to early May. Alibaba Group, JD.com and Tencent led the rebound.

Hong Kong-listed Meitu’s success stands in stark contrast to how many other firms struggle to monetise their own generative artificial intelligence initiatives.

Chinese authorities seem unlikely to deliver catalysts that would sustainably reverse negative investor sentiment, senior strategist Homin Lee says. Last week’s market-boosting measures prove insufficient.

Bearish investors dominated the local stock market in January, as China’s lack of stimulus showed up in weak manufacturing data. With the Fed seen on hold, there will not be any early relief for the city’s property market.

The government is actively engaging with mainland Chinese regulators to speed up the approval process for companies listing in the city. Measures will also be rolled out to attract family offices and wealthy individuals.

Shares in two China Evergrande subsidiaries stabilised when trading resumed in Hong Kong on Tuesday. The parent company remained suspended as court-appointed liquidators took control of its operations.

Stocks resumed decline, taking the local market to its worst January since 2016. A significant portion of Goldman clients still viewed the market as ‘uninvestable’. Shares in Evergrande units rebounded.

China’s policymakers soothe markets with stimulus balm, and respite may be brief as geopolitical, economic and policy risks lurk in the world’s second largest economy.

Stocks advanced, adding to a rebound last week on bets China will deliver more supporting measures. China Evergrande slumped after losing a winding-up litigation in Hong Kong.

The bill cites Chinese entities such as Third Military Medical University and Key Laboratory of High-Altitude Medicine as examples of ‘espionage tools’ of the Communist Party.

The Hang Seng Index marked its first winning week of the year, but the gains were trimmed to 4.2 per cent. Geopolitical risks will continue to be an overhang as this is an election year, Dickie Wong of Kingston Securities says.

China’s liquidity injection will help repair fragile sentiment towards the world’s second largest equity market, investment chief Rene Buehlmann says, adding that valuations are ‘very attractive’.

Stocks advanced for a third day, helping the market recoup more than US$400 billion of value since the plunge on Monday. The rout has galvanised Chinese authorities to act and repair confidence among investors.

Stocks in Hong Kong and mainland China surged again as China delivered on its promise to calm the market with a US$140 billion liquidity injection plan. Buying by corporate insiders lifted Alibaba by the most in six months.

The combined stakes of the two co-founders eclipsed SoftBank Group, which has reduced its shares in Alibaba through a series of forward contracts.

Founder Chua Soon Hock says his confidence as a trader is lost after markets in Hong Kong and Japan turned against him. ‘I have lost my knowledge, trading and psychological edge’ following a tough 2023 and a disastrous start to 2024, he says.

Stock indices in Hong Kong, Shanghai and Shenzhen jumped after a rout this month erased more than US$1 trillion of market value, prompting official reactions. Premier Li Qiang called for measures to calm investors.

The meeting chaired by Li was the clearest sign of the government’s attempt at putting a floor on plunging stock markets on the mainland and Hong Kong.

Shenzhen Gantang Mingshan Catering, which is behind popular Chinese restaurant chains including grilled fish diner Tanyu, could launch an IPO this year, sources say.