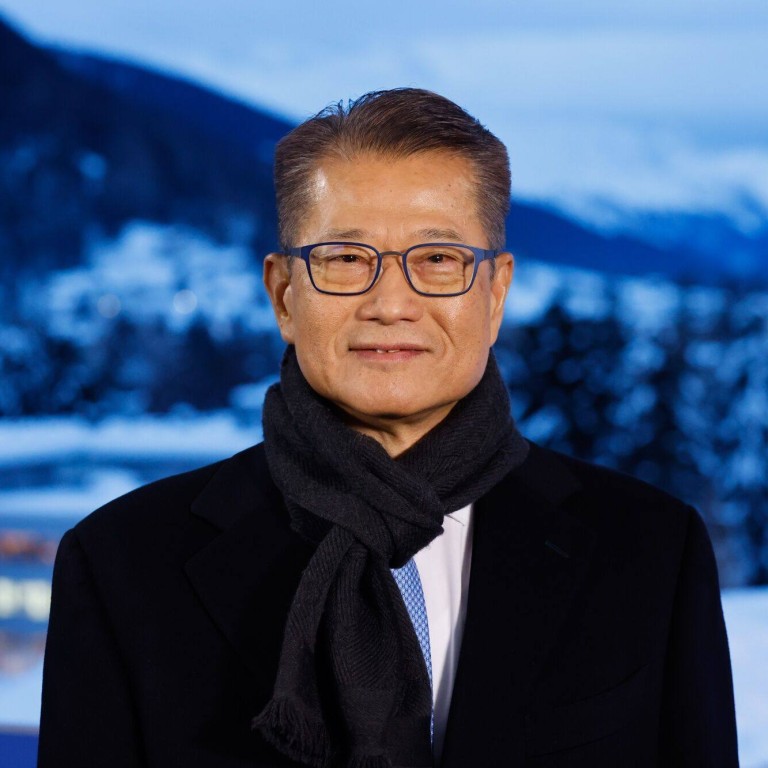

Hong Kong finance chief Paul Chan rules out capital gains tax for ‘foreseeable future’ for city

- Introduction of capital gains tax was just a suggestion brought up during the budget consultation period, Chan tells Post

- He also rejects idea of a land and sea departure tax

Hong Kong’s finance chief has ruled out the introduction of a controversial capital gains tax for the foreseeable future, saying any adjustment would affect the existing system’s competitiveness and the city’s economic conditions, as he also dismissed the idea of a departure levy.

“During the consultation period, there were many people who had different opinions. As a responsible government, we must do our due diligence,” he said on Wednesday.

“Any adjustment to our tax system impacts a number of things and we have to be very careful. For example, the competitiveness of our tax system, overall economic situation, the impact on our people and business, and business spending in Hong Kong.

“So it seems in the foreseeable future, Hong Kong does not have the conditions to implement a capital gains tax.”

Noting that the city’s main rival, Singapore, did not have such a tax either, Chan reiterated that the competitiveness of Hong Kong’s tax system was definitely one of the considerations for imposing any levy.

Chan sought to reassure the public that like many economies worldwide, Hong Kong was going through the same “peaceful consolidation”, despite the huge estimated deficit.

“Because in the past few years during Covid, the government needed to spend quite a lot to support the economy, to alleviate the impact on the people,” he said.

Hong Kong business, not national security, tops Davos discussions: finance chief

“Now, we are in the process of fiscal consolidation. The idea is to take two to three years’ time to return the budget to its balance. In the meantime, we have investment income to be brought back to the government.”

Investment bank JP Morgan had warned that the introduction of a capital gains tax could trigger panic sales in the property market, after Chan said he would consider the option when a resident flagged it on a radio show earlier this month.

Hong Kong, Saudi Arabia eye deeper cooperation, Arab expansion into Asia

According to a report by the bank, individual capital gains tax from selling assets such as property and stocks could lead to short-term pressure on home prices, though the impact might only be temporary.

The finance chief also rejected calls from the Liberal Party for a land and sea departure tax to be introduced in a bid to help cut the deficit, in light of a growing trend of Hongkongers heading across the border for entertainment, shopping and dining.

The pro-business party’s suggestion drew scorn from economists and politicians who warned the “politically insensitive” idea could backfire.

Economist Terence Chong Tai-leung said Chan’s earlier “consideration” of a capital gains tax would have aroused fear, deterring local and foreign investors from buying assets.

Hong Kong Liberal Party’s departure tax proposal slammed as ‘insensitive’

“Investors would feel unsure about buying assets as they did not know if such a tax would be imposed on them soon,” said Chong, executive director of Chinese University’s Lau Chor Tak Institute of Global Economics and Finance.

“It is good to do an early clarification as it might have caused panic selling.”

Chong also suggested the government boost its land sales by first removing all cooling measures related to the property market, thus boosting confidence among homebuyers and developers.

Regina Ip Lau Suk-yee, convenor of the city’s key decision-making Executive Council, said she was happy with Chan’s clarification, adding that he “needs to do more to restore confidence”.

Paul Chan aims to ‘clear up doubts about Hong Kong’ at Davos forum

Lawmaker Louis Loong Hon-biu, who represents the real estate and construction sector, also welcomed Chan’s clarification, saying the city’s edge lay in its simple tax system compared with other economies.

“We should never introduce such a tax, as this will be a stupid move destroying the city’s advantages,” he said.

Earlier this month, Chan said the government would review some charges for public services and those based on a user-pays principle in a bid to raise revenue for the public coffers following the massive spending tied to the pandemic.

Chan is in the process of gauging public views ahead of his budget speech set to be delivered on February 28.

Additional reporting by Jeffie Lam