Here’s how corporate leaders can boost Hong Kong’s moribund stock market

- More aggressive share buy-backs and insider buying – more common in the US – will mop up undervalued shares, instil confidence and reward long-term shareholders

So, what’s wrong with the Hong Kong market? Compared to the late 1990s, Hong Kong companies have stronger balance sheets, greater global competitiveness, and a more stable currency regime. Looking at the 850 largest companies in Hong Kong, our analysis reveals that about half have more cash than debt and the majority (67 per cent) remain profitable.

According to our research based on Bloomberg data and information on the Hong Kong exchange’s website, out of more than 2,000 listed companies, 467 paid dividends over the last 12 months, while just 238 repurchased shares. Even those buy-backs have been meagre – only 52 firms repurchased more than 2 per cent of their outstanding shares. The time for boldness is now: stocks are cheap and investors are looking to business leaders to instil confidence.

The time has come for Hong Kong’s market to evolve. The experience of the US shows CEOs who embrace share buy-backs and bet on their company’s shares reap rewards. Take AutoZone for example. Since a 1991 initial public offering, the auto parts business has grown its revenue at a respectable 10 per cent per year, but its shares have done even better by returning 21 per cent annually.

Autozone’s management is focused on profitability and returning cash via buy-backs. The stock’s return for investors outpacing sales growth can be largely explained by AutoZone managers repurchasing aggressively to reduce their share count by more than 88 per cent over the last 25 years.

Over that period, on average AutoZone bought back and cancelled 8 per cent of its shares each year. Steady and aggressive repurchases compound over time. AutoZone shareholders have enjoyed a 490-fold return on their shares.

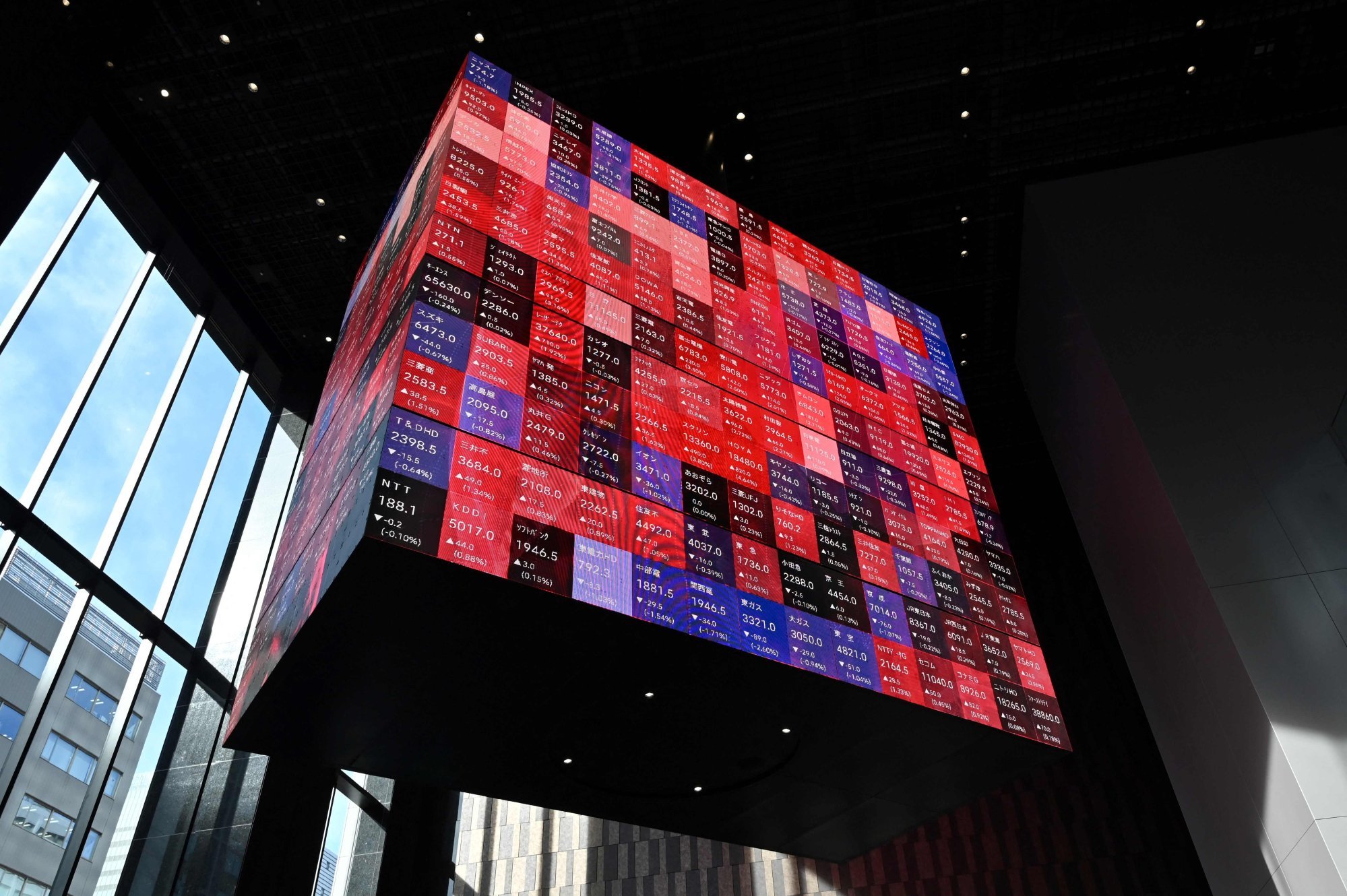

Significant buy-backs like these are the exception and not the rule, especially in the Hong Kong market. The Hong Kong exchange should take a page from the Tokyo Stock Exchange and pressure poorly run companies to treat shareholders better.

Hong Kong CEOs can decry the market undervaluing their firms, but talk is cheap. Which companies are taking advantage of market sell-offs to close the gap between fair value and the market price?

Hong Kong’s investors deserve better from its corporate leadership to bring life back to its once-vibrant stock market. More aggressive buy-backs and insiders buying can deliver that.

Daniel Rupp is founder and chief investment officer of Parkway Capital, based in Hong Kong