_1.jpg?itok=B52InIHL)

Topic

The "Greater Bay Area" refers to the Chinese government's scheme to link the cities of Hong Kong, Macau, Guangzhou, Shenzhen, Zhuhai, Foshan, Zhongshan, Dongguan, Huizhou, Jiangmen and Zhaoqing into an integrated economic and business hub.

City still has a lot of advantages despite new regulations that will allow the tropical island to attract domestic and international visitors as well as businesspeople.

- Social media and video gaming giant Tencent has shelled out 6.42 billion yuan to buy land in the Haidian district of Beijing

- Last October, video gaming powerhouse miHoYo and fintech giant Ant Group splurged on land plots in Shanghai and Hangzhou respectively

New home sales in the Greater Bay Area might increase by 5 per cent this year, thanks to improving transport networks and the introduction of more favourable policies, Cushman & Wakefield says.

China Aoyuan is the latest among debt-stricken home builders to win forbearance from offshore creditors and courts to cure their defaulted debts as China’s property market struggles to overturn a multi-year slump.

Twynam Funds Management, an asset-management company owned by one of the richest families in Australia, is looking for investment targets in Hong Kong for a new fund focused on cutting carbon emissions.

Hong Kong’s business community is set to turbocharge plans to capitalise on the city’s initiatives to be one of the world’s top wealth centres and talent hubs, while eyeing growth in the wider bay area too, Post survey finds.

The state-controlled conglomerate joined forces with Hong Kong’s New World Development on a venture worth US$1.28 billion in the city’s Northern Metropolis mega project, according to sources familiar with the matter.

Beijing has drawn up a blueprint designed to foster a world-leading business environment in its Greater Bay Area of Guangdong, Hong Kong and Macau.

Deal on data transfer boosts Hong Kong’s role in the Greater Bay Area City’s standing in the broader economic powerhouse can only be enhanced by pilot scheme that will offer comfort to businesses and the mainland authorities.

The summit came just a day before Hong Kong inaugurated an academy to provide financial and skills training in wealth management to support the family-office industry.

Since the border reopened, Hongkongers, particularly retirees, have started to think once again about buying property in the bay area, say analysts. The falling yuan and a slew of measures to boost the market are making the prospect more attractive.

Two thirds of firms in the economic hub have adopted sustainable development practices in their business operations, and investments relating to ESG by such enterprises could reach HK$1 trillion (US$127.8 billion) in the next two years, according to a report by the Hong Kong Trade Development Council (HKTDC) and UOB.

Hybrid work arrangements, which include some combination of working from homes working at a desk in remote co-working spaces and coming into traditional offices, are a way to create significant cost savings.

StartmeupHK, which will mark its first full return to physical events since the Covid-19 pandemic, is seen as a bellwether for sentiment in the Hong Kong tech industry.

Overseas talent coming to Hong Kong should consider learning Mandarin as businesses flock to the city and the Greater Bay Area, according to recruitment consultants.

Hong Kong is poised to name Clara Chan as the first CEO of a new HK$62 billion (US$8 billion) fund being established to invest in businesses across the Greater Bay Area, according to sources.

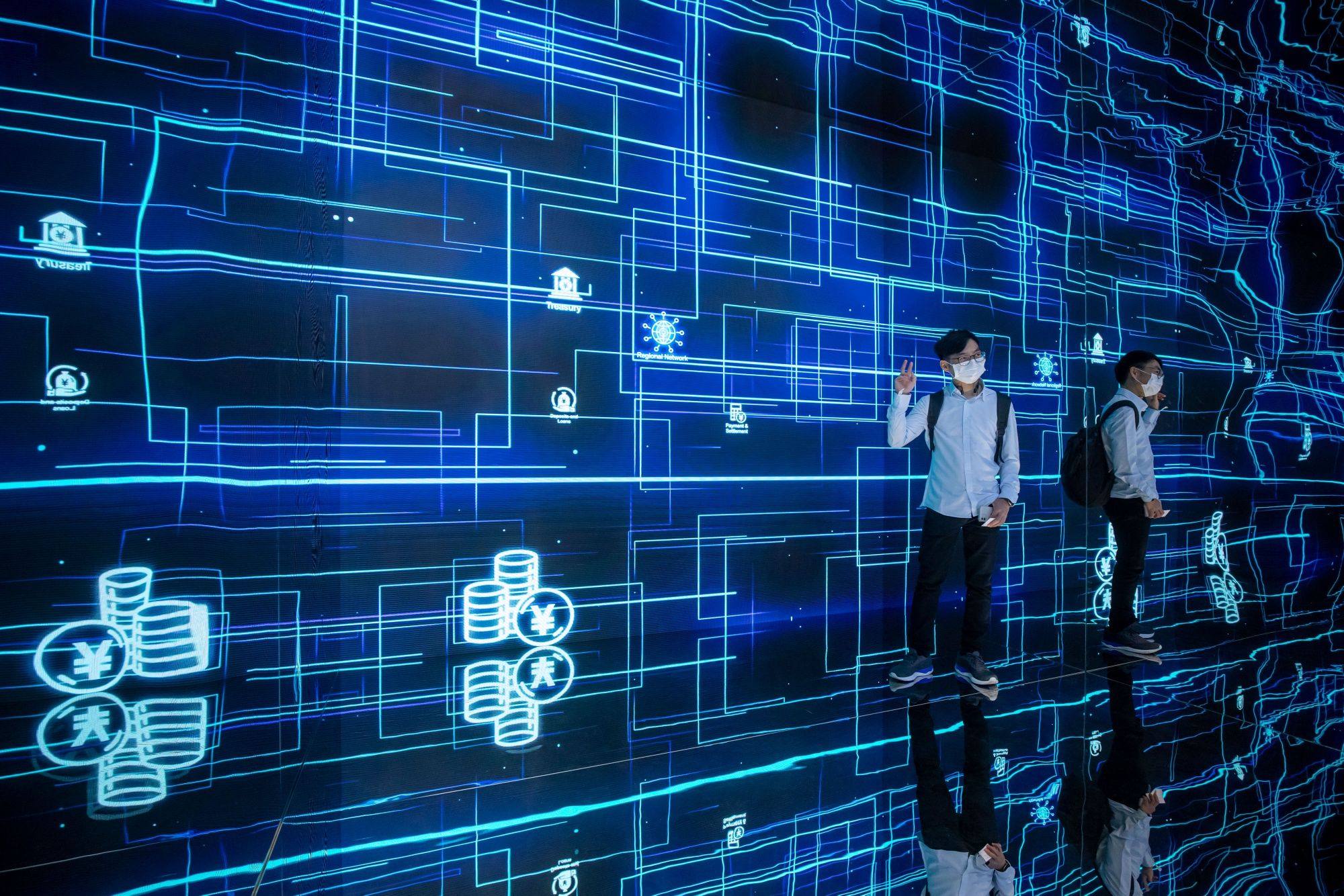

New measures will further ‘cross-boundary investment … and the development of Hong Kong’s financial industry’, says monetary authority CEO.

Flex space provider IWG says it is adding locations rapidly in the Greater Bay Area as property owners seek to capitalise on the trend. Major landlords Hongkong Land and Swire Properties also have their fingers in the co-working pie.

The FinTech Association of Hong Kong and the Shenzhen FinTech Association have started working together for the first time as GBA opportunities loom.

The new branch in Shenzhen is one of the first Hong Kong projects in the Hetao zone, which will take the lead in serving hi-tech companies, as the two cities work on building a global hub.

New World Development sold more than 10 billion yuan (US$1.37 billion) worth of residential projects in mainland China in the first eight months of the year, the company said in a statement on Monday.

Country Garden warns of hefty first-half loss amid multiple challenges, including deterioration in sales and tough financing environment.

A slowdown in public markets has hurt demand for office leasing in Hong Kong, but a turnaround in deal activity with a boost from blockbuster listings could improve the prospects for the second half of the year, according to real estate firm Savills.

Hong Kong residents with family members holding residence permits in Shenzhen are eligible for the first time for government-subsidised housing after authorities relaxed rules to help low-income families get on the property ladder.

The Indian market has proved to be a bright spot for the firm, thanks to two blockbuster deals this year worth US$1.38 and US$1.87 billion involving the sprawling Adani Group. Jefferies is ‘long-term bullish’ on China.

Legislators point to automated model which cuts out second identity card check regularly required at crossings with mainland China.

Saudi Arabia’s top diplomat in southern China says the Greater Bay Area will be ‘the future of Asia’, but first some problems must be tackled in the economic and business hub.

Hong Kong firms are well-placed to take advantage of opportunities given the crisis facing their mainland rivals, but the economic situation warrants caution, analysts say.

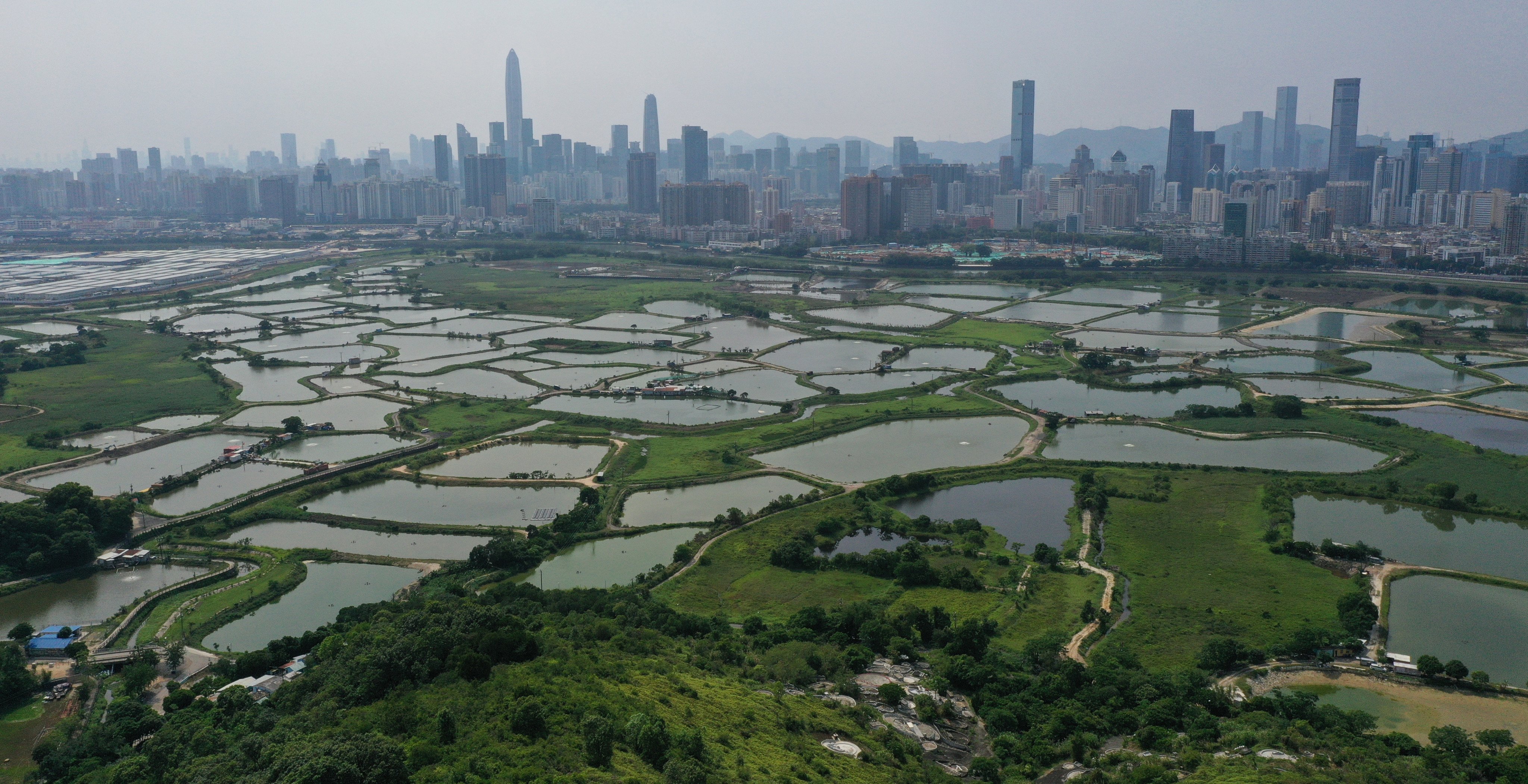

Without solid plans, investors are wary of taking first steps even though they are generally supportive of the ambitious 627-hectare San Tin Technopole project in the northern New Territories, consultancy says.