Chinese companies are on the move – inland and to Southeast Asia

- Domestic developments such as rising wages and stricter environmental regulations in addition to geopolitical factors have pushed Chinese companies to shift their operations either within the country or overseas

- This ability to adapt quickly to changing conditions will help Chinese firms to survive a challenging environment

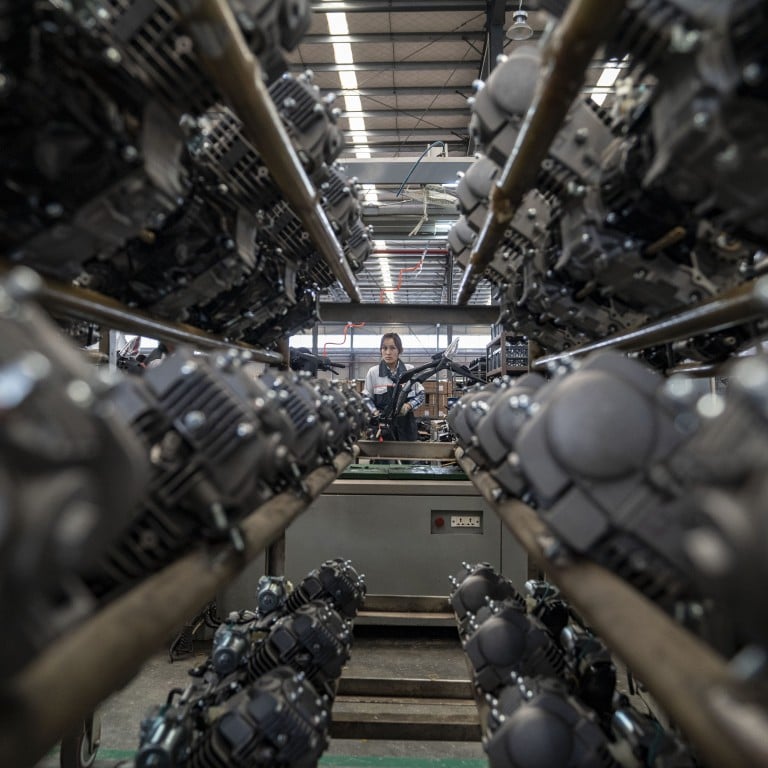

Inland movement has gained momentum as businesses strategically relocate to regions within China that offer economic advantages and lower operational costs. This strategic shift reflects a proactive approach to counteracting challenges and maintaining competitiveness amid a dynamic global business landscape.

To promote development of the inland provinces, the Chinese government is proactively encouraging manufacturing firms in coastal provinces to diversify and relocate or move part their production more inland. Since 2010, a series of guidelines have been issued to encourage inland transfers from the eastern coastal cities to the central and western regions. The objective is to achieve more balanced regional development, accelerate industrialisation and urbanisation in inland areas and foster economic upgrading in the eastern region.

In conjunction with the initiatives undertaken by the central government, regional authorities in inland areas have also implemented a range of policies to attract manufacturing firms to relocate in their areas. These encompass subsidies, tax incentives, streamlined approval processes, assurance of labour supply and various cost reduction measures.

Chinese inland cities, such as Chengdu and Kunming, offer a multitude of advantages, making them attractive destinations for industrial transfer. The low wages in these regions reduce production costs for businesses, enhancing their overall competitiveness in the global market.

Inland cities feature a vast and thriving consumer market, contributing to nearly half of China’s gross domestic product. Their economic size and growing middle class present attractive opportunities for businesses.

The well-developed infrastructure in inland cities, including efficient transportation, reliable telecommunications and stable power supply, ensures smooth operations and logistical efficiency for the manufacturing firms.

Finally, China’s inland cities are renowned for their complete industrial supply chains, well-developed industrial ecosystems and comprehensive industrial support networks, providing businesses with the necessary resources and services.

Chinese firms view Southeast Asian countries as favourable locations for offshore production. These countries actively engage in free trade agreements, leading to lower tariffs and reduced trade barriers.

Excitement as China’s visa-free deals could trigger Asean trade, investment boon

Asean countries benefit from strategic geographical advantages. Convenient sea transportation through their numerous ports enhances their connectivity and accessibility to global markets. Moreover, many Asean economies offer the benefit of low labour costs, making them attractive destinations for labour-intensive industries.

Chinese firms are increasingly leveraging Asean’s potential for global market competitiveness, as outward direct investment from China to Asean has been steadily rising since 2010. This expansion spans various sectors, including advanced industries like electronics, batteries and motor vehicle parts and semiconductors, as well as services such as e-commerce and hospitality.

Ultimately, the decision to relocate to China’s inland regions or Asean countries depends on the industry’s unique characteristics and market dynamics. Industries targeting the domestic market with strong industrial support and a skilled labour force tend to relocate to China’s inland cities.

Industries focusing on overseas markets with large or rapidly growing middle class, may prefer to relocate to Asean economies with their low labour costs and preferential trade agreements, including with the US.

Everything considered, the trend of the Chinese firms’ strategic relocation to China’s inland cities or expanding into Asean mirrors a broader global pattern observed among advanced economies such as the United Kingdom, Germany, the United States, Japan and South Korea.

The pivotal factor shaping the location of Chinese firms lies in their adept navigation of the shifts in market forces. The ability to skilfully relocate and restructure manufacturing industries will play a crucial role in positioning Chinese companies on a more competitive and high-value-added path.

As the landscape of global markets continues to evolve, the strategic choices made by Chinese firms in response to market forces, technological advances or geopolitical tensions will be instrumental in determining their success on the international stage.

Dr Hongyan Zhao is an economist at the ASEAN+3 Macroeconomic Research Office (Amro)