China’s clean energy boom ‘an example to the entire world’, IEA analyst says

- Renewable capacity is expanding at an unprecedented pace, with China’s solar PV installations last year equal to the world’s total in 2022, report says

- Nation also dominates in solar manufacturing, which has pushed down the cost of modules by more than 80 per cent in a decade, according to analyst

What China has achieved is “an example to the entire world”, according to Heymi Bahar, a senior analyst with the IEA.

He made the remarks after the IEA released its annual renewable outlook report earlier this month.

According to the report, China’s renewable energy capacity expansion last year was driven by solar photovoltaic installations, which were equal to the total solar capacity added by the rest of the world in 2022.

Bahar said China was also the biggest producer of solar PV modules, manufacturing around 80 per cent of the modules worldwide.

That had led to a decline in solar module prices of more than an 80 per cent over the last decade, he said.

Bahar said lower prices for solar modules helped “all countries in the world to expand solar PV deployment”.

Imports could also be vital to meet the global target for renewable energy capacity.

While countries like the United States and Brazil had record increases in their renewable energy capacity last year, China’s additions were far greater.

Bahar said China was “key” to meeting the Cop28 pledge to triple capacity globally, as it accounted for “almost 40 per cent of cumulative installed renewable capacity worldwide”.

In the report, the IEA said that from 2023 to 2028, “China will deploy almost four times more renewable capacity than the European Union and five times more than the United States”.

It said China could even reach its 2030 target of installing a total of 1,200 gigawatts of wind and solar capacity this year – “six years ahead of schedule”.

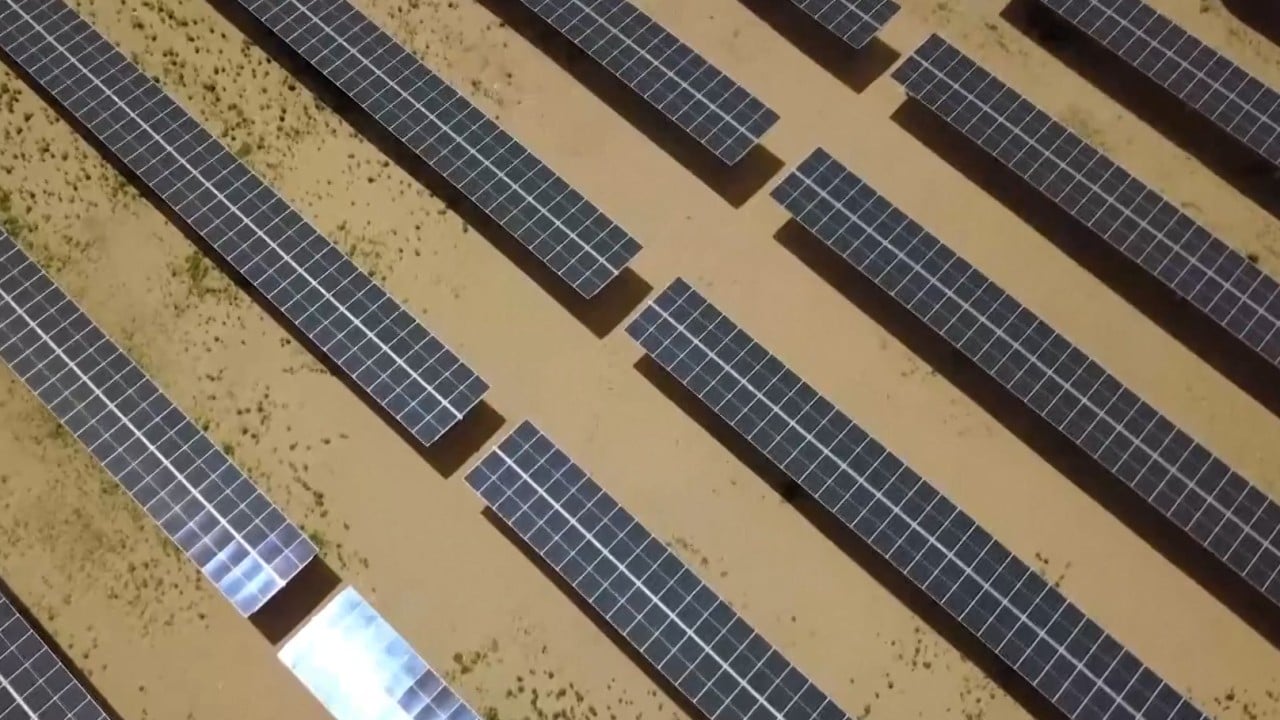

China engineers complete largest solar farm on Earth in UAE ahead of Cop28

The report also noted that China’s solar PV manufacturing capacity “now strongly exceeds both local and global demand, which has driven module prices down significantly”.

Elsewhere, manufacturing costs are significantly higher. In 2023, it cost an estimated 30 per cent more to make a polysilicon PV module in the US than it did in China, according to the report. In India, the manufacturing cost was 10 per cent higher than in China, and it was 60 per cent higher in the EU.

The IEA expected the price gap to continue widening. It estimated that from 2023 to 2028 it would cost US$12 billion to replace Chinese PV imports with domestically made modules in the United States. The figure was US$8 billion for both the EU and India.

Growth in China’s solar and wind capacity is being driven by a supportive policy environment and the economic attractiveness of renewable technology in the country, according to the report.

It said an estimated 96 per cent of new utility-scale onshore wind and solar PV last year “had lower generation costs than new coal and natural gas plants”. And around 75 per cent of new wind and solar facilities provided cheaper power than existing fossil fuel plants.

China rolled out a “green electricity certificate” scheme nationwide last year as a way to encourage the use of renewable energy and power trading from resource-rich provinces to others.

The programme aligns with “a more market-oriented approach to increase renewable energy integration”, according to Zhang Hao, an associate professor of law at Chinese University of Hong Kong.

China’s voluntary carbon market reboots in ‘milestone’ for emissions goals

He said it could help overcome provincial barriers to trading renewable energy. It might also replace mandates like provincial targets which he said were “unsustainable due to weak regulatory capacities at the central level”.

Zhang said renewable energy would continue to be a policy priority but noted that decentralisation of energy governance complicated Beijing’s control over the sector’s development.

“Addressing vulnerabilities in the supply chain and shifting the focus from capacity addition to integration are crucial needs that deserve attention in the regulatory and policy framework,” he said.