Topic

Some officials in the Chinese government are so desperate to get their desired narrative across that they have started to disregard basic principles, an approach which may carry a high cost in the long run.

The pain of this colossal corporate failure will be worth it if the country can diversify its growth strategy away from the addiction of property development.

While it is necessary for China to have a broad security perspective on financial dealings, it is debatable to what extent cops and spies should be involved in real-world finance projects.

- Hang Seng Index retreats after rising to highest since January 11; markets look to Alibaba’s earnings to add to other recent bullish report cards

- State fund support may not sustain mini-rally as drivers of negative sentiment are not being addressed, says Brock Silvers at Kaiyuan Capital

China’s securities regulator rolls out a slew of measures in a bid to reverse a stock market rout that is seen threatening the financial system and posing a risk to social stability.

‘People are interested in India for several reasons, one is simply it’s not China,’ says Vikas Pershad, a money manager at M&G Investments in Singapore. ‘There’s a genuine long-term growth story here.’

A bull market is vital for China’s slowing economy because stock valuation has slumped to about 54 per cent of national output, from a record 79 per cent in 2021.

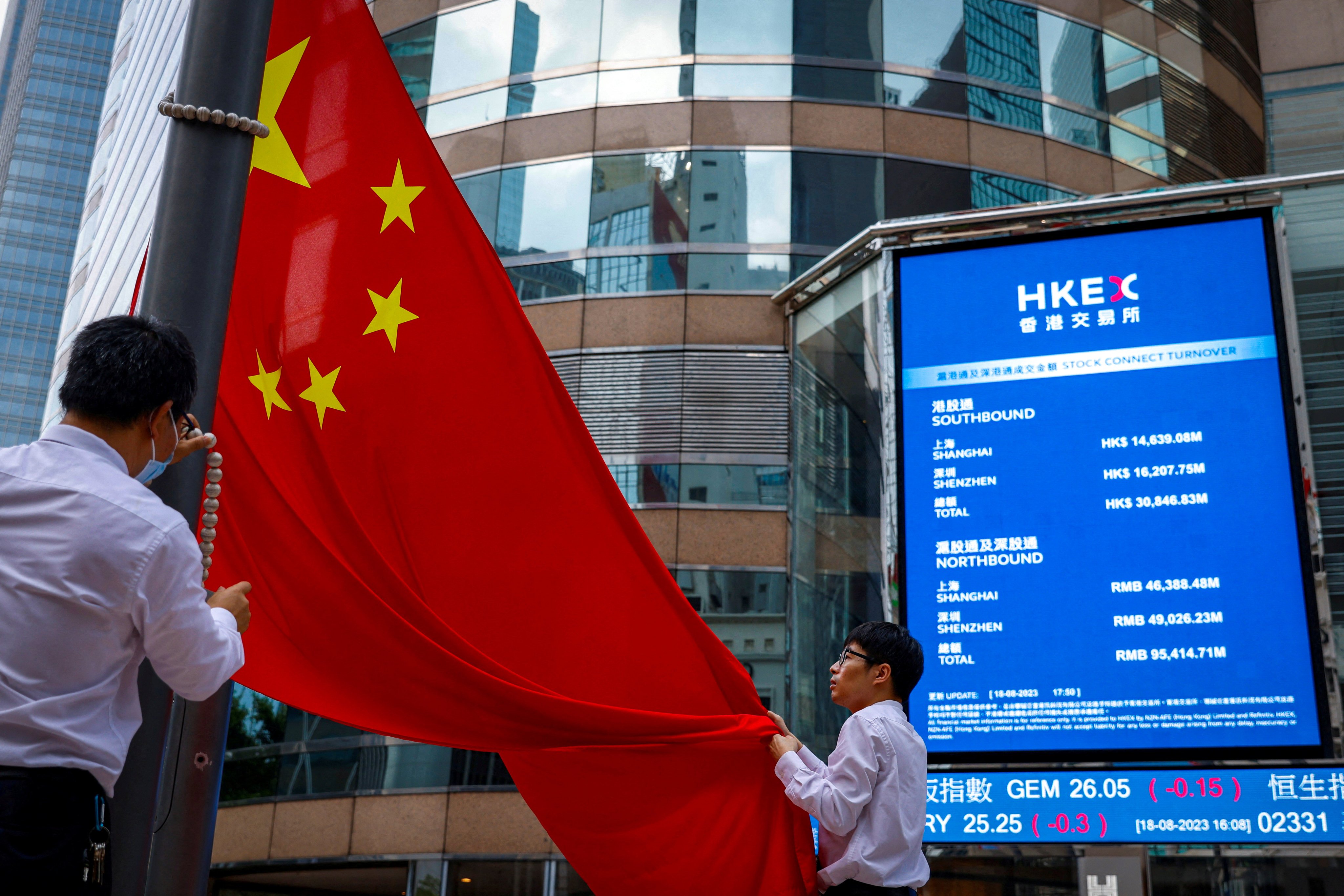

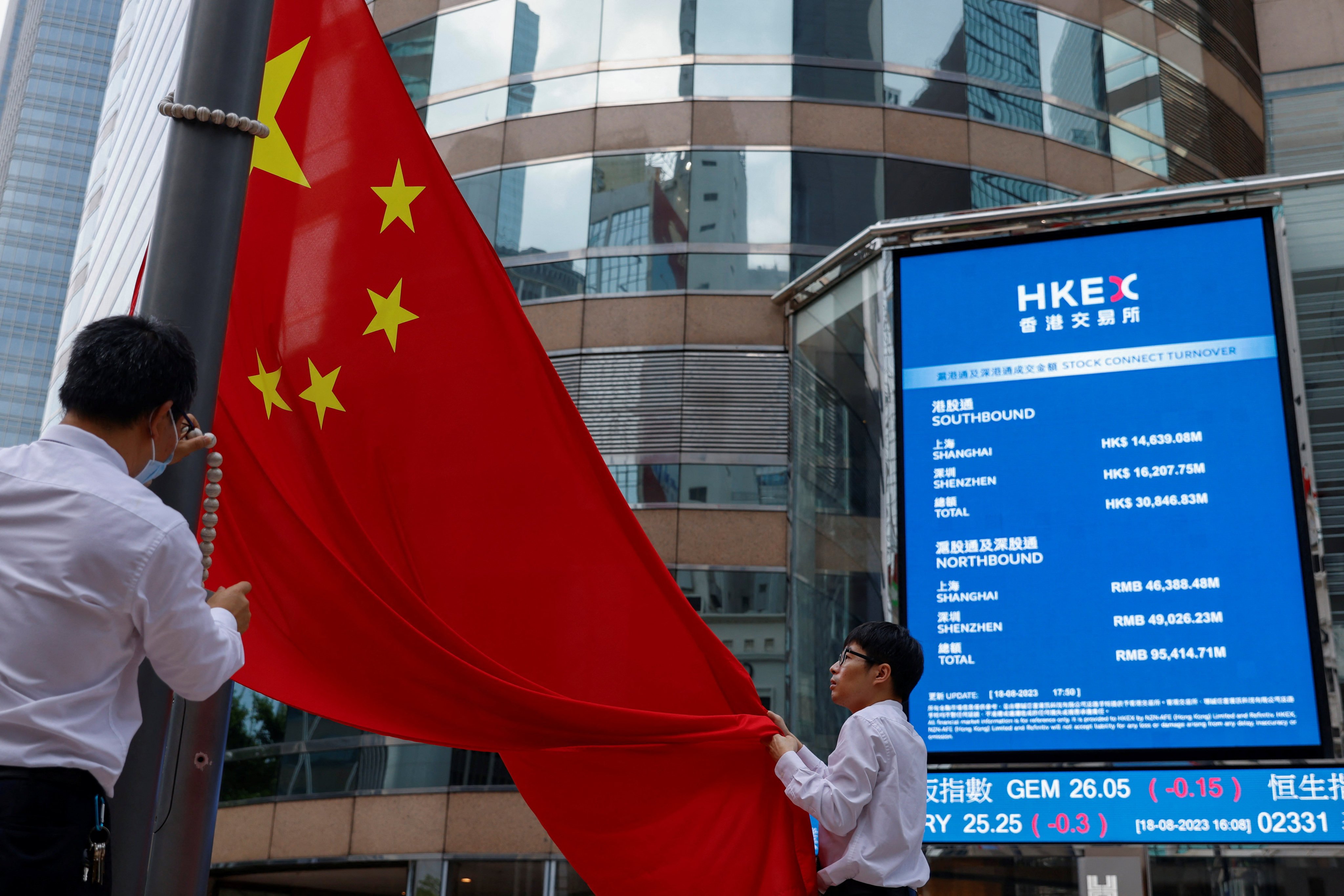

Hong Kong stocks jumped by the most since July while onshore equities logged a historic gain. Market regulator in Beijing pledged fresh measures to stop the rot, and the sovereign wealth fund made its market intervention public.

Hong Kong stocks fell on Monday, after the CSRC’s pledge to rein in wild fluctuations in the stock market did not include details as to how it will revive investor confidence. US Presidential hopeful Donald Trump’s threat that he may levy further tariffs on Chinese goods added to the gloom.

Chinese restaurant chain operators are grossly underpriced in the stock market, and they are set to expand their dominance as consumption rebounds, analysts say.

A statement by Qianhe Capital cites ‘personal reasons’ for Wang’s move and says the company has ‘ample liquidity’.

Stocks declined, capping another week of losses, after WuXi Biologics suffered another major plunge. Market surrendered an earlier rally fuelled by favourable Beijing policy and robust EV deliveries in January.

An investigation by the China Securities Regulatory Commission found the 2023 financial disclosures of Beijing Zuojiang Technology to be ‘seriously untrue’.

Stocks recovered from a 9.2 per cent sell-off in January as traders raised bets for a US rate cut to early May. Alibaba Group, JD.com and Tencent led the rebound.

Chinese authorities seem unlikely to deliver catalysts that would sustainably reverse negative investor sentiment, senior strategist Homin Lee says. Last week’s market-boosting measures prove insufficient.

Bearish investors dominated the local stock market in January, as China’s lack of stimulus showed up in weak manufacturing data. With the Fed seen on hold, there will not be any early relief for the city’s property market.

He Lifeng tells cadres to step up support for ‘high-quality development’ to stem loss of confidence and entice sceptical investors.

Burned by years of underperformance in Chinese domestic stocks, local investor appetite for overseas equities is running so high that it’s fuelling huge price distortions in funds tracking these assets.

Shares in two China Evergrande subsidiaries stabilised when trading resumed in Hong Kong on Tuesday. The parent company remained suspended as court-appointed liquidators took control of its operations.

Stocks resumed decline, taking the local market to its worst January since 2016. A significant portion of Goldman clients still viewed the market as ‘uninvestable’. Shares in Evergrande units rebounded.

China’s policymakers soothe markets with stimulus balm, and respite may be brief as geopolitical, economic and policy risks lurk in the world’s second largest economy.

Stocks advanced, adding to a rebound last week on bets China will deliver more supporting measures. China Evergrande slumped after losing a winding-up litigation in Hong Kong.

Chinese regulators on Sunday barred strategic investors from lending securities during restricted periods, a move signalling that policymakers are serious about stabilising the country’s stock markets amid volatility.

Today, not much resembles the reels in Blossoms Shanghai. China’s legion of 200 million retail investors can be forgiven for hankering for that gravity-defying bygone era of the 1990s.

The bill cites Chinese entities such as Third Military Medical University and Key Laboratory of High-Altitude Medicine as examples of ‘espionage tools’ of the Communist Party.

The Hang Seng Index marked its first winning week of the year, but the gains were trimmed to 4.2 per cent. Geopolitical risks will continue to be an overhang as this is an election year, Dickie Wong of Kingston Securities says.

Hong Kong’s role as a ‘superconnector’ between the capital markets of mainland China and the rest of the world will continue because of hugely untapped investment opportunities, HKEX CEO says.

China’s liquidity injection will help repair fragile sentiment towards the world’s second largest equity market, investment chief Rene Buehlmann says, adding that valuations are ‘very attractive’.

Stocks advanced for a third day, helping the market recoup more than US$400 billion of value since the plunge on Monday. The rout has galvanised Chinese authorities to act and repair confidence among investors.