Topic

China’s property market has surged in recent years. After prices jumped 25 per cent in 2009 alone, the central government imposed austerity measures, including lending curbs, higher mortgage rates and restrictions on the number of homes each family can buy.

The pain of this colossal corporate failure will be worth it if the country can diversify its growth strategy away from the addiction of property development.

- Hong Kong is likely to see the biggest price decline of up to 10 per cent and as much as 3.9 per cent in Singapore, according to a Savills report

- Prime residential property in the 30 cities monitored by Savills to see overall price growth of 0.6 per cent this year versus 2.2 per cent in 2023

Some of China’s biggest provincial economies are looking to expand and diversify their financial resources this year, largely to fund economy-boosting construction projects, but analysts say this could run counter to Beijing’s de-risking campaign.

China’s other sectors like electric vehicles and demand from India are likely to offset some impact, but exporters will have to seek newer markets, analysts say.

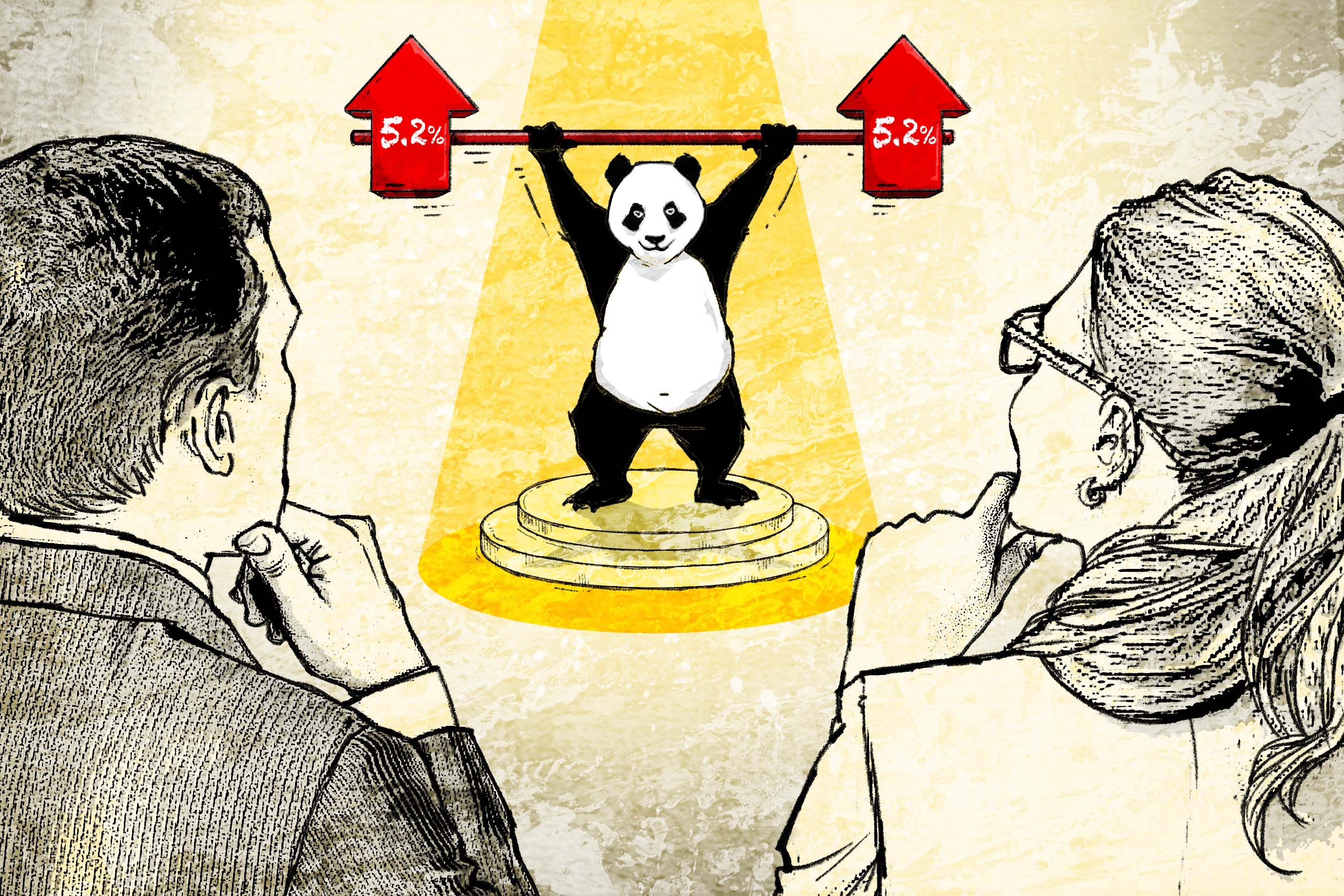

After China’s GDP growth surpassed expectations in 2023, the US-based research firm says Beijing needs to acknowledge that slower annual growth in the range of 3-4 per cent ‘is here to stay’.

Hong Kong and mainland Chinese banks are preparing for a new cross-border payment regime that will make it easier for Hong Kong and Macau homebuyers to transfer the funds they need to purchase property in the Greater Bay Area.

Sunac China Holdings, Shimao Group, CIFI Group and Country Garden Holdings are among property developers whose projects have been included in ‘whitelists’, a mechanism that qualifies their projects for financial support from banks.

Sentiment has waned and some potential homebuyers would rather extend their leases instead of buying a home, China Index Academy analyst says.

Gold’s rising role as a safe-haven investment in China has made it the world’s top buyer while traditional assets such as real estate and stocks are seen as more risky.

No bids were received for Fengtao’s ‘other account receivables’ at the end of the 24-hour deadline on Friday morning, according to auction platform Jingdong Paimai.

Despite a slew of measures rolled out by Chinese regulators recently to boost demand for property, developers are still struggling with weak sales and reported declines of more than 40 per cent in January.

Analysts continue to call for more aggressive stimulus measures to invigorate the job market, after employees saw salaries suffer their biggest quarterly decline in years across dozens of major Chinese cities.

The liquidation order could be difficult to implement as most of Evergrande’s assets are not in the three mainland Chinese cities covered under a cross-border scheme, according to S&P Global Ratings.

China’s measures to boost the nation’s troubled housing market are trickling down to the provincial and city levels, with more cities relaxing curbs to buy property.

Chinese authorities seem unlikely to deliver catalysts that would sustainably reverse negative investor sentiment, senior strategist Homin Lee says. Last week’s market-boosting measures prove insufficient.

Pimco, one of the world’s largest asset managers overseeing assets worth US$2 trillion, has called for more fiscal support from China to prop up consumer sentiment and the housing market.

Hong Kong developer Hang Lung named Adriel Chan to succeed his father Ronnie Chan as its chairman, at a time when the real estate market is coming under more pressure and home prices are at a seven-year low.

Shares in two China Evergrande subsidiaries stabilised when trading resumed in Hong Kong on Tuesday. The parent company remained suspended as court-appointed liquidators took control of its operations.

A winding-up order against China Evergrande Group, one of the world’s most indebted property developers, sparked a rally in the rest of the sector amid hopes authorities will introduce easing measures for the remaining players.

Liquidators of collapsed Auckland-based construction company Mainzeal are pursuing Shanghai businessman Richard Yan for over NZ$60 million that he owes to the company’s creditors, in a case that has implications for Chinese developers operating in New Zealand.

Some question whether Hong Kong liquidators will be able to secure recognition and help from mainland Chinese courts to effectively seize Evergrande assets on the mainland.

The lawsuit was initiated in June 2022 by Lin Ho-man’s Top Shine Global, which was trying to recover HK$862.5 million (US$110.4 million) from Evergrande after a botched investment in March 2021.

Challenges related to national security, data flows and market barriers still dominate hearts and minds, fuelling doubts about increasing investments in China, as well as contemplations about exploring overseas opportunities.

The land grab comes as the domestic technology sector continues to recover from several years of regulatory upheaval, which has seen many firms scale back their operations.

The F&B sector, which contributed nearly half of Hong Kong’s retail leasing demand last year driven by new Chinese restaurants, will continue to be the biggest source of demand in 2024 as well, according to CBRE.

Shanghai Mayor Gong Zheng said the policy initiative to support more foreign direct investments would buttress the city’s economic recovery efforts in 2024.