Topic

Latest news and analysis about housing and property in Asia, covering sales, market outlook and investment trends, policies related to affordability and foreign ownership, and the performance of developers.

Post investigation into luxury estates confirms scale of unauthorised additions, such as swimming pools and basements, and signals it’s time for effective regulatory reforms

The Housing Authority will need more money if the Hong Kong government is to meet its accommodation targets for the less well-off.

Redevelopment of Hong Kong’s ageing districts is to be welcomed, but feelings of those who are affected have to be respected.

- Hong Kong is likely to see the biggest price decline of up to 10 per cent and as much as 3.9 per cent in Singapore, according to a Savills report

- Prime residential property in the 30 cities monitored by Savills to see overall price growth of 0.6 per cent this year versus 2.2 per cent in 2023

The church has secured several floors at the property at 413-423 King’s Road as its ‘future permanent home in Hong Kong’, it said in a statement on its website.

Sunac China Holdings, Shimao Group, CIFI Group and Country Garden Holdings are among property developers whose projects have been included in ‘whitelists’, a mechanism that qualifies their projects for financial support from banks.

Sentiment has waned and some potential homebuyers would rather extend their leases instead of buying a home, China Index Academy analyst says.

Cash-strapped owners are taking out loans with rates of up to 29 per cent, with luxury properties in areas like The Peak and Repulse Bay as collateral.

Gold’s rising role as a safe-haven investment in China has made it the world’s top buyer while traditional assets such as real estate and stocks are seen as more risky.

Property deals in Hong Kong surged in January to their highest since August on stepped-up buying amid expectations of stable interest rates and hopes that a government residency scheme will draw more investments into the sector.

Despite a slew of measures rolled out by Chinese regulators recently to boost demand for property, developers are still struggling with weak sales and reported declines of more than 40 per cent in January.

Housing Authority says reclaimed flats came from the first batch of about 88,000 tenants who made declarations about whether they owned residential property.

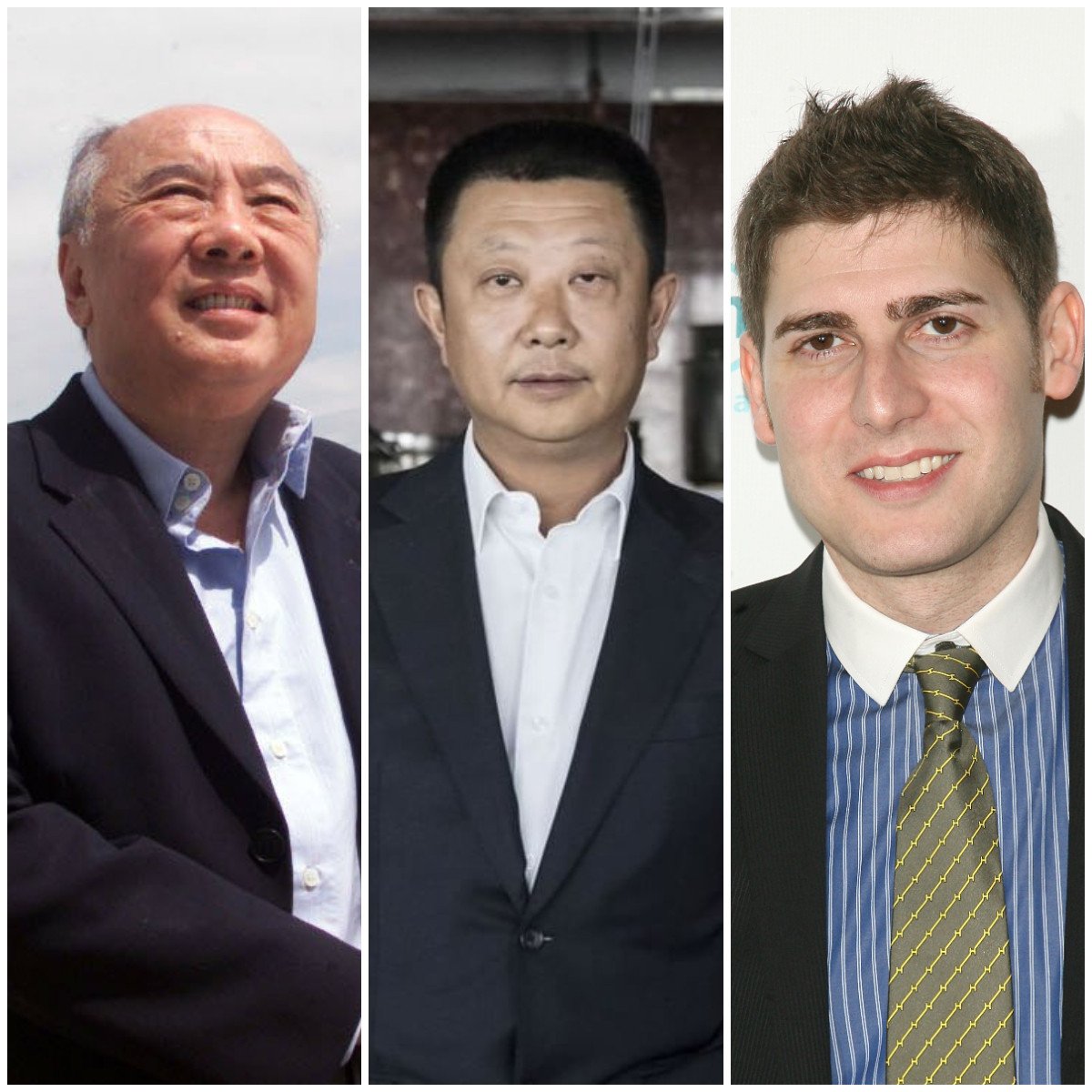

Haidilao founder Zhang Yong and fan of Tesla’s Elon Musk, Leo Koguan, all make the list – but which famous tech founder is the richest in the Lion City?

Hong Kong’s lived-in home prices fell by about 1.4 per cent, the eight straight monthly decline. Overall, prices fell 6.7 per cent in 2023, versus a much sharper slump than the 15 per cent decline a year earlier.

A push into the city and population decline are two reasons they sit empty, as well as the Japanese preference to newly built homes rather than pre-owned.

Hong Kong’s industrial property segment is seeing a pick up in demand, with the likes of Microsoft committing to long-term leases for data centre facilities, property consultancy JLL said.

Franklin Templeton, which has leased 21,700 sq ft on the 62nd floor of Two IFC, will shift from its present premises in Chater House. Last week, China Re leased 6,740 sq ft in the 88-storey tower.

The scale and extent of the impact, however, remains to be seen, even as half of those who availed visas under the Business Innovation and Investment Programme last year were from mainland China and Hong Kong, Juwai IQI’s Daniel Ho says.

Hong Suk-joon of the ruling People Power Party said that a Chinese property buying spree can put upward pressure on housing prices.

The two-storey, 11,687 sq ft detached house on Lugard Road went on sale in October and was valued at HK$1.3 billion (US$166 million).

Hong Kong’s luxury property segment is showing signs of a revival, with mainland buyers returning to the market. Analysts expect developers to ramp up supply amid increasing demand and lower rates ahead.

Beijing and Shanghai issued their latest round of support measures last December to shore up confidence. The measures seem to have yielded solid results. But analysts say the trend is far from sustainable.

Many Chinese developers in Australia and New Zealand have closed or scaled back, amid a property crisis in China, weak demand and higher construction costs.

State-owned companies will dominate as the age of ‘fast leverage and fast growth’ is over, and developers face brutal years ahead, analysts said.

Investment in Hong Kong property fell by 28 per cent to HK$37 billion (US$4.73 billion) last year, its lowest level since the 2008 financial crisis, but is expected to rise to HK$50 billion in 2024, Colliers says.

HDB said it has successfully delivered about 80 per cent of pandemic-delayed projects, or a total of 73 projects from October 2020 to December 2023.

Hong Kong’s decade-long property bull run, stopped in its tracks during the pandemic, plunged into negative territory after the local monetary authority raised interest rates in lockstep with the US Federal Reserve.