Stock market prices in Japan, the US and elsewhere are being inflated by stimulus, suggesting a picture of economic health. But a correction delayed is not a correction averted.

The US, the largest commercial property market in the world, has seen prices tumble since the Federal Reserve started raising interest rates. The knock-on impact of falling property prices on the banking system, securities markets and real economy could be serious, and reverberate into international financial markets.

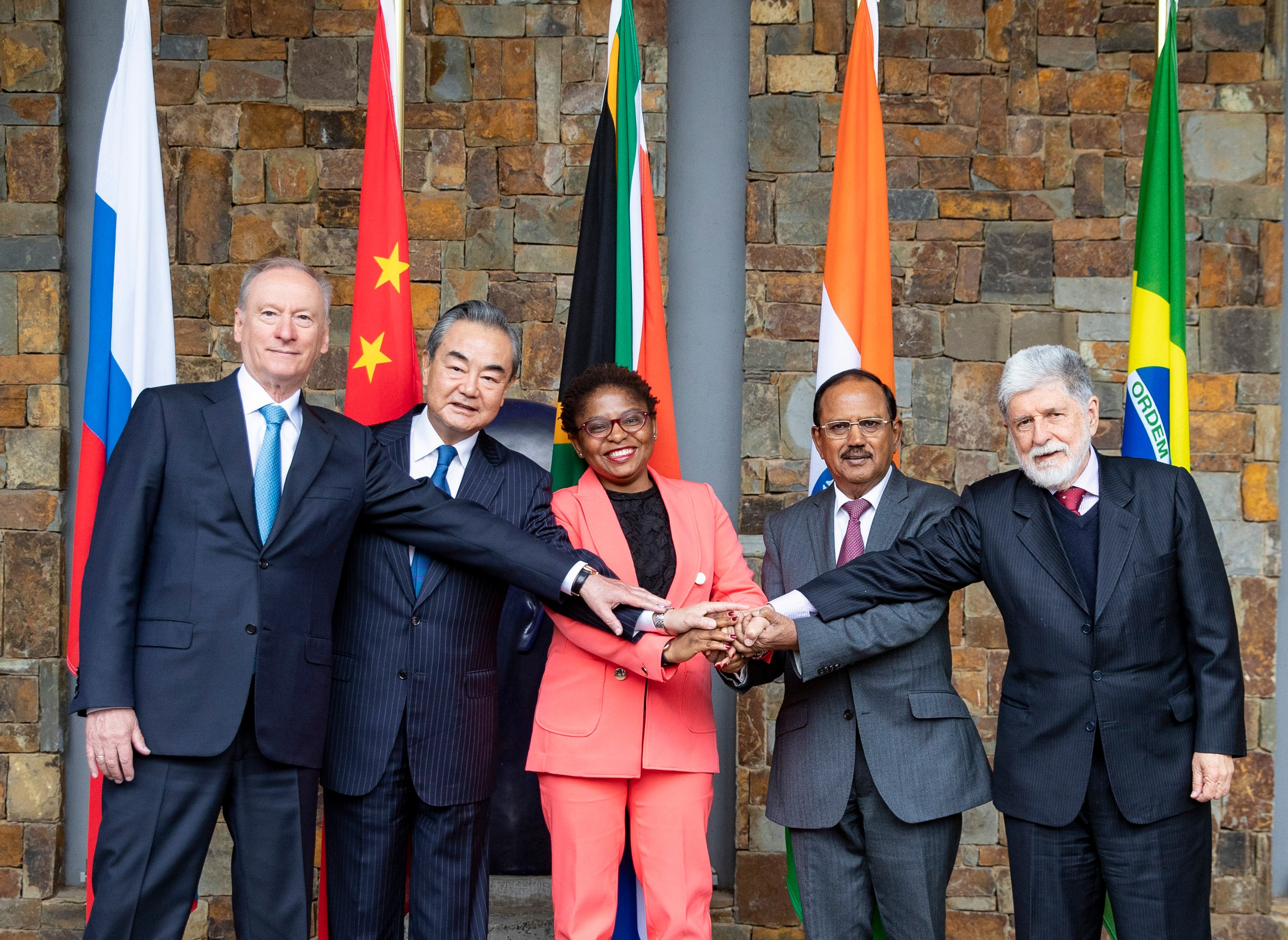

China’s grand infrastructure initiative needs wider ownership, a stronger institutional structure and more money. It could gain these if it were incorporated into the newly enlarged Brics grouping.

Much of Asia’s growth in recent years has been built on a foundation of strategic stability, but that under threat in a series of potential flashpoints. Leaders and policymakers must know it is dangerously irresponsible to risk lives and livelihoods in the hope of scoring points against their opponents.

Whether we call it belief in God or a guiding external force or simply superstition, inculcating faith or the conviction that we are accountable to someone or something greater than ourselves can both defeat nihilism and provoke great creative actions.

While certain countries are trying to entrench the current world order, there is a vast transition taking place that will alter the global balance of power and efforts to stop it are akin to putting a finger in the proverbial dyke.

Prime Minister Fumio Kishida and his party are flailing in response to a fundraising scandal, shaking Japan’s image as an island of stability. Japan’s political structure has clearly not matured and stabilised in the post-war period to the same extent that its institutional and economic structure has.

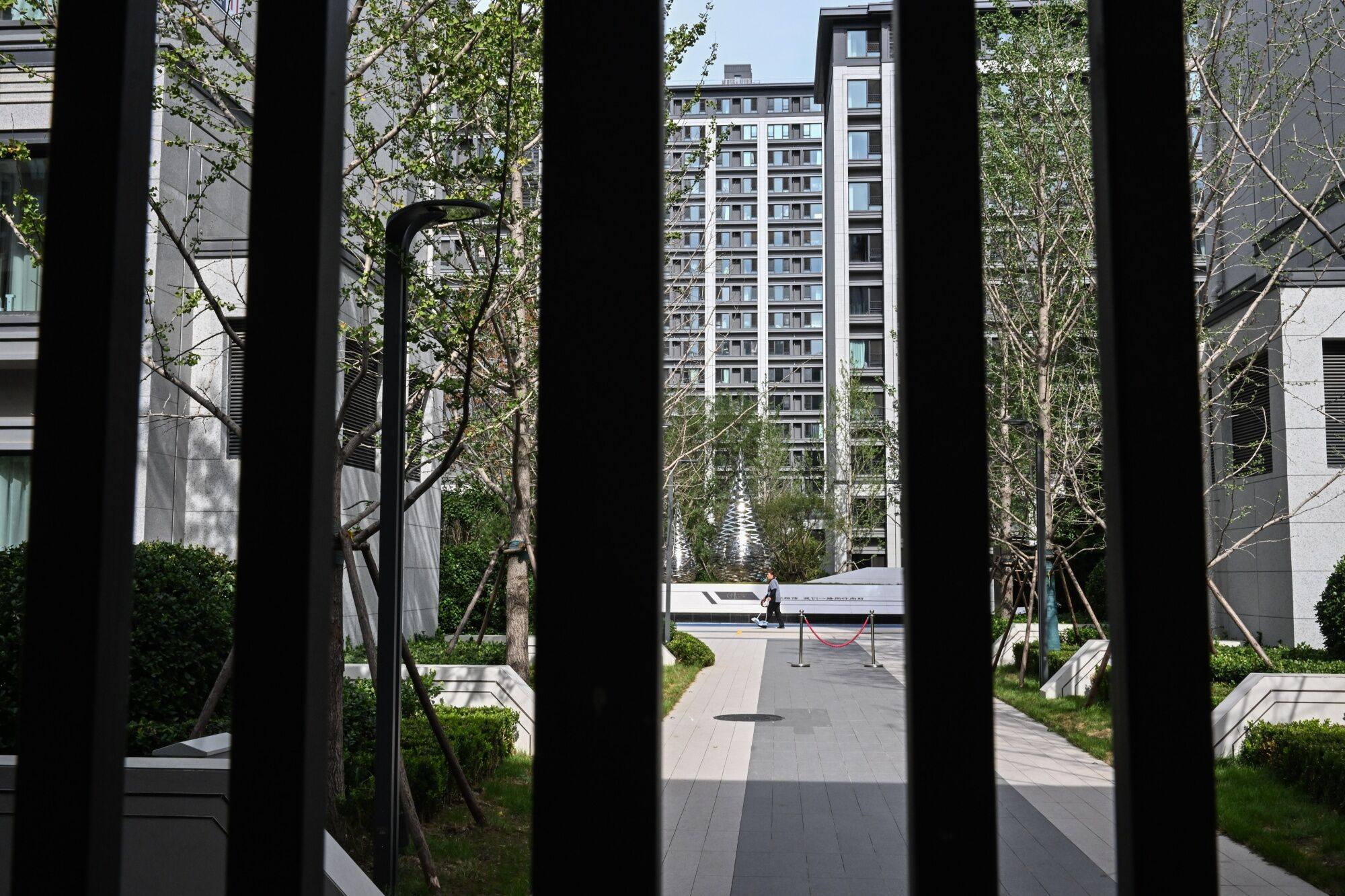

The world must face the reality that China’s property sector is not the biggest economic threat and the chance of ‘soft landings’ elsewhere is just an illusion. Legacies of past monetary and fiscal excesses and present economic systemic fragmentation will undermine major economies.

Global warming cannot be met by anything other than a coordinated global response, but logic stands little chance against politics and nationalism, as seen at Cop28.

The crisis in China’s property sector has been in the spotlight in the past year, but the rise in global debt levels should not escape the world’s attention. Investors and analysts have been more focused on inflation, but with price rises abating, debt is likely to be the leading concern once again.

As more central banks explore or push to launch digital currencies, the world is looking likely to fragment into currency blocs. This would reinforce the growing use of local currencies in cross-border payments and hasten a long-term decline in reliance on the US dollar.

With the world at a critical point, government, public agency and private sector resources must be combined and directed towards projects that can truly make a difference.

The debate on deglobalisation has become much more complex than when Donald Trump started putting up tariff barriers. But whether it’s global supply chains for chips or foreign investment flows, it seems there is no going back to the way world trade was.

Changes in monetary policy have a lagged effect. The Federal Reserve’s abrupt switch to tightening last year is now resulting in investor confusion. Today’s bond market jitters and monetary squeeze bring to mind the situation leading up to 1987’s global market crash, but the Fed seems oblivious.

As the West starts to find its feet with financing for its infrastructure, it would be a pity if the largesse was used to compete with China, when the global scale of the challenge calls for cooperation.

World Bank president Ajay Banga recently spoke of the need to press private finance into service to tackle climate change and other critical objectives. While those in asset management might protest about losing their investment freedoms, his logic is hard to argue with.

China’s rise and US protectionism have raised questions about the Western economic model, which has helped cause turbulence in emerging economies. Global agreement is needed on a more universal model.

The problem with markets in most advanced and developing economies is that they favour short-term investment, not long-term socio-economic projects. This is why the US struggles to finance and improve transport and other infrastructure at the national level, but China doesn’t.

Amid shifts in geopolitics, supply chains and global trade, companies have been scared into rethinking how they operate and invest. Government officials who are reshaping the world economy without a sound understanding of consequences could well break the system.

Pressure from inflation and rising interest rates may have abated but global debt is rising again amid shadow banking risks, putting financial stability in jeopardy. It’s time to set aside ‘light touch’ financial supervision.

Why is a spotlight focused on everything “bad” in China while adverse developments elsewhere are treated as though they were happening on the dark side of the moon?

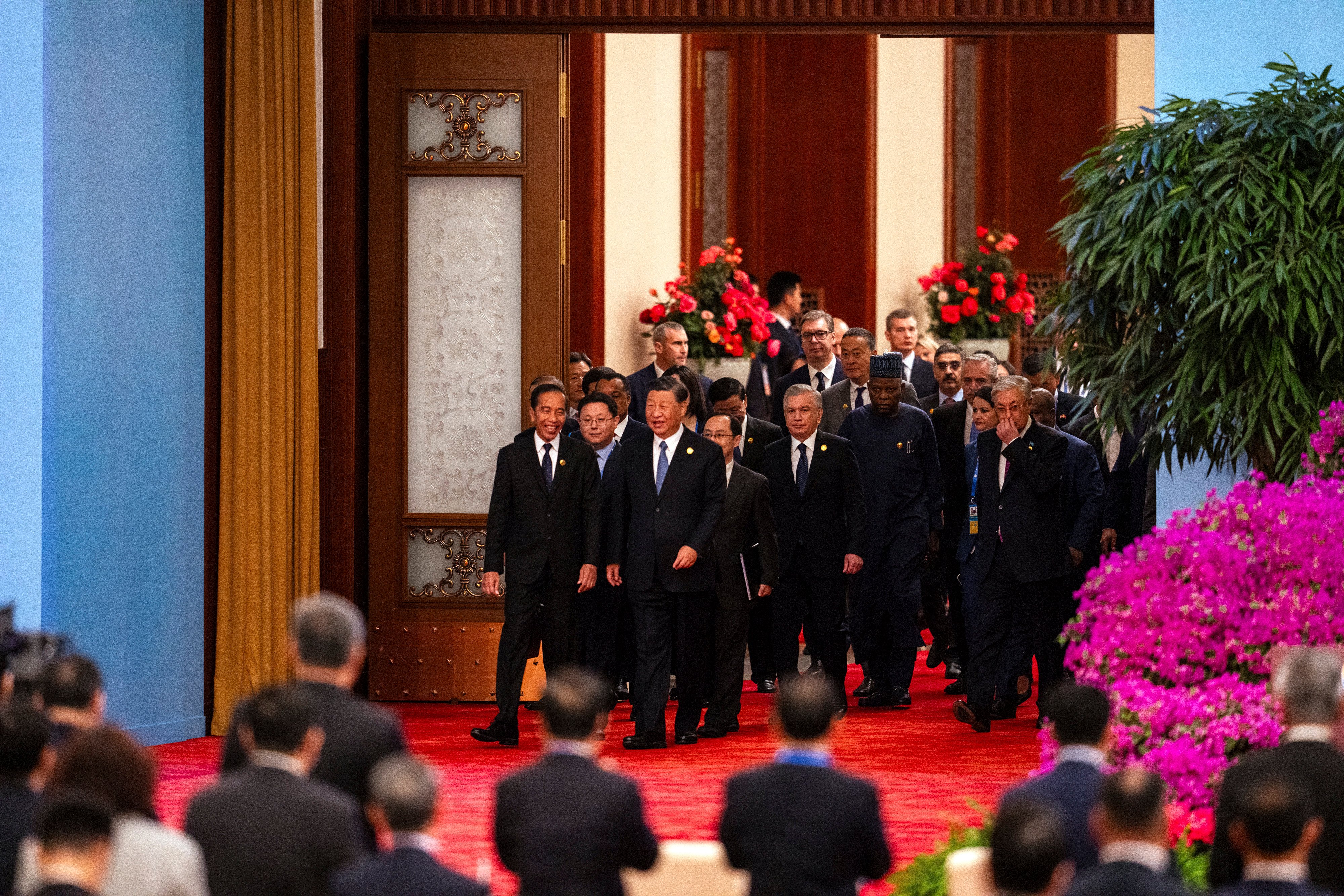

From G20 to Brics, the more the West seeks to weaken the India-China axis crucial to regional cooperation, the more Asia’s statesmen must stand together.

The global dominance of the US dollar has allowed America to finance government spending with debt that seemingly does not need to be repaid. Expect Brics to know that a currency of their own will be good for more than trade.

Beijing’s challenges cannot be properly analysed and understood in a context where China bashing is normalised. The West should stop its petty rhetoric or risk escalating frictions into confrontation, to no one’s benefit.

Washington policymakers and Wall Street traders are choosing to shrug off the growing concern over management of federal government debt. Doing so when many other countries are anxious to lessen their dependence on the US government securities market and the dollar is courting trouble.

Not only are more countries keen to join the bloc, its push for reform of the global economic and financial system is gathering pace, and the economic heft of the economies involved means they cannot be dismissed lightly.

The split between the reality on the ground and the way in which it is perceived by investors and market analysts seems to be growing ever wider. The IMF and others are warning about the continuing risk of a hard landing, yet investors are still on a stock-buying frenzy.

Currency devaluation is a common temptation for major trading nations such as China despite the risk of starting currency wars. A recent report argues devaluing the yuan could bring major benefits and spur China and others to experiment further.

At their meeting this week, G20 finance ministers are warned against any premature celebration. Despite data that showed price rises are moderating, the battle is not yet over.

US-China tension is souring the atmosphere of international cooperation, complicating the management of currency reserves, and raising war risks. In this context, arguing over whether the US is decoupling or de-risking is futile – to Beijing, it’s all the same.