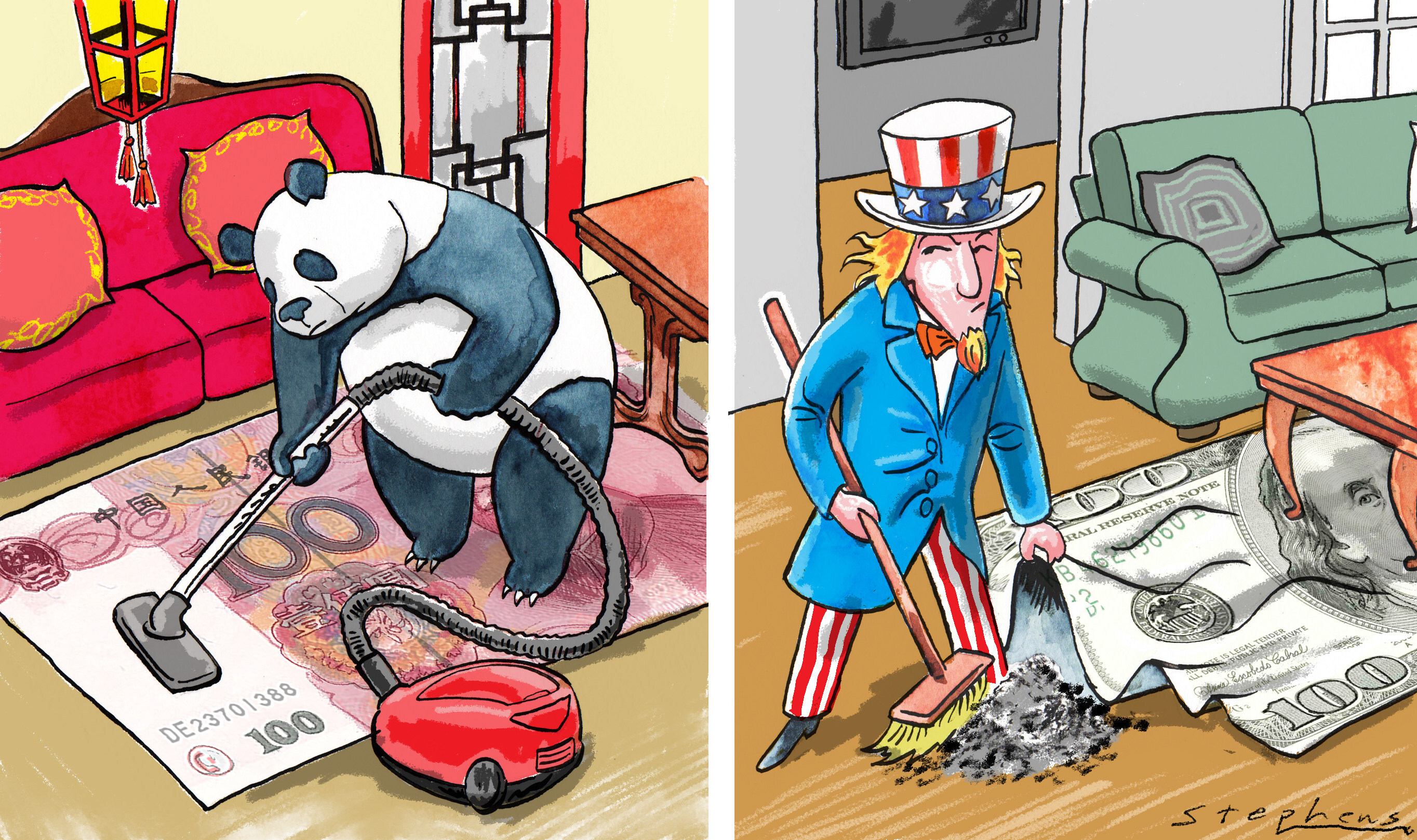

As its economy matures and becomes more competitive from battling the severe headwinds of recent times, China should have the confidence to let its currency reflect its true strength.

Beijing is right to hold back on coming to the rescue of the property sector, which would reinflate the real estate bubble. If it must use stimulus, it should spend a few percentages of GDP a year on a solar energy push, which could make the country energy and food independent.

Given the US bubble economy, a rising fiscal deficit and foolish behaviour of markets, the Federal Reserve faces a tough balancing act. It has already had to walk back some dovish statements, and further policy mistakes risk damage to the entire global economy.

China is using its downturn to deflate bubbles and raise productivity while the US is doing the opposite – feeding the Bernanke bubble and hoping for an AI cure for falling productivity

The effects of war and inflation could send US financial markets into a tailspin, forcing China to completely ‘unpeg’ from the dollar – which could then collapse.

Amid rising dollar risks, Brics states should integrate their currency and bond markets, and tax dollar transactions to promote local currency use.

In an era of deglobalisation, disinflation in China won’t help to moderate price rises in the rest of the world, as long as the drivers of inflation – including a massive monetary overhang – hold strong. More to the point, inflation will last for as long as confidence in the US dollar holds.

China’s current challenges are the result of misallocation of resources in its boom years; the troubles in the property sector are a symptom of this , not the cause. Competition and productivity are the main forces behind today’s deflationary pressure, and this is a positive development.

China is gently deflating its property bubble and absorbing overcapacities as it waits for demand to return. This could take a long time but China has the luxury to dither.

Hong Kong risks increasingly forced in step with US monetary policy, which could see property prices and the economy comes crashing down. Switching to the yuan would mean stability and a chance to ride the currency’s rise before it becomes fully convertible.

China has the supply chain, the better tech and the cheaper costs that keep on falling. Trade barriers would only force the world into two prices for one product – where the cheaper one is also likely to be better.

The economy stagnated as it was no longer as competitive, but misfiring central bank policies that propped up inefficient conglomerates made things worse. Unless Japan corrects its course soon, the future will be dire.

China’s pursuit of technological self-sufficiency risks leading to overcapacity and price wars, creating ripple effects across many industries. The current experience may motivate China to look into its other vulnerabilities and develop domestic substitutes, spreading overcapacity across many industries.

Expect more banking and bond fund blow-ups with the US reluctant to stop the endemic moral hazard in its financial system, preferring to lean on the dollar.

China’s coal revival has capped energy imports and prices as it works towards energy self-sufficiency. But for true energy security and a stable global energy market, China must boost its nuclear and solar power

The developing world needs China and its lower-cost goods, vast capacity and massive surplus capital. Robust trade with the Global South will support China’s growth and offers it another pathway to high-income status – even as its relationship with the West sours.

Even before the pandemic, China faced a turning point in its growth model as investment returns began to shrink. As long as policymakers prolong the needed transition to a consumption-based economy, growth will remain low for years to come.

As the Fed boosted liquidity, the odds of cooking up a successful scam improved greatly – and more people did. Now that the Fed is winding down its bloated balance sheet, hot-air assets like cryptocurrencies are losing their life line.

Facing financial catastrophe in 2008, instead of fixing the imbalances of the global economy the Fed flooded the system with liquidity and kept interest rates low, sparking a speculative frenzy that has lasted to this day.

The decline in the number of marriages, the most significant driver of property demand, leaves China looking at a massive inventory that will take at least 10 years to digest. Without downsizing and reforms, the property industry will become a zombie.

The Taiwan crisis has deepened the divergence between China and the US-led West. While markets might believe that trade is the new mutually assured destruction, history tells another story.

Central banks are assuring markets they are dealing with spiralling inflation while doing nothing of the sort. That’s because the only solution is to cut the flow of money, but neither governments nor markets are ready to reform their high-spending and highly speculative habits.

As long as China can maintain industrial production, thanks to the closed-loop system that keeps workers isolated, service-sector weakness will probably be tolerated. Covid-19 is here to stay and this raises the question of whether zero-Covid is a policy mistake or a tool for social control.

Persistent lockdowns and hardening political rhetoric suggest China’s zero-tolerance approach to Covid-19 will stay in place. Collapsing demand, falling middle-class income, supply chain disruptions and a weakening yuan will have consequences that ripple across the globe.

China’s ‘zero-Covid’ approach is disrupting supply chains and could cause damage well beyond the country’s borders. While economic costs alone will not bring a change of direction when politics is driving policy, the reality of the virus’ infectiousness may compel Beijing to tolerate certain levels of infection.

With no swift resolution to the Ukraine war in sight and a risk of the conflict spreading, markets must wake up to the reality of massive energy and food supply shocks. The likelihood that financial bubbles will burst, triggering a global recession, is growing by the day.

While investors tremble at the prospect of falling asset prices and tighter monetary policy, the working class is set to benefit from rising wages. Strong wage growth could drive consumption and prop up the global economy while overvalued stocks and real estate tumble.

Financial markets seem in denial as China and Russia seek to roll back US dominance and reassert their own sphere of influence. Any military confrontation would be a shock to the global economy. In particular, war over Taiwan could have devastating repercussions.

China’s financial system could soon be strong enough to withstand a stronger currency, leaving the US vulnerable to a currency shock. Floating the renminbi then could tip the US deeper into inflation and turmoil while giving Beijing free rein in international affairs.

In cutting coal production but not consumption, the West is simply outsourcing its carbon footprint to China and other coal-dependent emerging markets.